Pricing is one of the most consequential marketing decisions a company makes. It directly affects profitability, customer perception, competitive positioning, and the behavior of sales teams. While analysis and data can inform pricing choices, the responsibility for setting a price — and living with its consequences — remains Human.

The Value Pricing page exists to support this moment of responsibility. It helps you approach pricing decisions deliberately: how to relate price to perceived value, how to arbitrate trade-offs between volume and margin, and how to define pricing principles that can be defended over time.

In an AI-assisted world, pricing simulations and recommendations are increasingly accessible. This page focuses on what AI cannot assume: judgment, accountability, and the ability to set prices that reflect strategic intent, customer value, and business priorities.

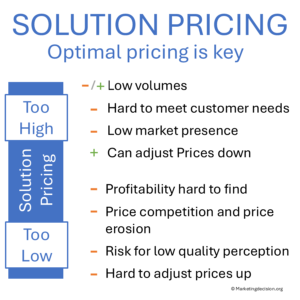

Setting the right price for a solution is essential for both market success and long-term competitiveness. If the price is set too high, the solution may fail to meet customers’ needs and expectations, leading to weak positioning and low adoption. If the price is set too low, the company may unintentionally pressure competitors to reduce their prices as well, destabilizing the market and limiting profitability for everyone.

In every purchasing decision, customer perceived value and price remain closely connected, yet fundamentally different. Customers may perceive one solution as offering greater value but still choose a lower-priced alternative for reasons tied to budget constraints or internal priorities. Conversely, they may select a higher-priced solution if they believe its value justifies the difference.

In every purchasing decision, customer perceived value and price remain closely connected, yet fundamentally different. Customers may perceive one solution as offering greater value but still choose a lower-priced alternative for reasons tied to budget constraints or internal priorities. Conversely, they may select a higher-priced solution if they believe its value justifies the difference.

Perceived value is subjective and varies significantly across customers, whereas price is set by the company and managed through clear commercial decisions. This distinction is crucial. It is also why tools such as the Price-Value Map are invaluable. They allow teams to compare solutions consistently and understand how perceived value and price interact across different segments.

This chapter explains the role of Value Pricing, focusing on how companies set and manage prices to meet business objectives while ensuring that customers remain satisfied—both at the moment of purchase and when renewing or upgrading to a new solution.

Value Pricing begins with a simple idea: a solution should be priced according to the value that customers perceive, not according to internal costs or industry conventions. Although this principle sounds straightforward, in practice it is more nuanced.

What makes Value Pricing particularly relevant for complex solutions is that customers do not evaluate value based solely on features or specifications. They consider the entire experience: support levels, configuration flexibility, quality expectations, and the credibility of the supplier. As a result, pricing cannot be detached from value, and any attempt to do so risks weakening the commercial proposal.

This is also why Value Pricing naturally connects to other areas such as Solution Perceived Value, Value Creation, and Value Selling. Pricing, in this context, becomes the visible expression of a broader value strategy.

Price is often defined as the amount a customer is willing to pay. This definition is helpful but not entirely accurate, because price is ultimately set by companies. Customers will choose whether or not to accept it, depending on how well the solution matches their needs and perceived benefits.

In many cases, sales teams determine the optimal discount to align the proposed price with what a customer is prepared to pay. The goal is to protect profitability while ensuring that the offer remains attractive. Sales teams often excel at this balancing act: they know their customers well, understand the constraints of each segment, and can judge whether a higher price will succeed or when a lower price is required to win a deal.

Many price terms are commonly used to clarify decisions:

Many price terms are commonly used to clarify decisions:

Each of these exists for a reason. They reflect different levels of decision authority, and they help ensure that salespeople and marketing teams operate with the same understanding of how price evolves throughout the process.

Because solutions often include many capabilities, services, and configuration options, pricing becomes more than a simple number. It is a strategic signal—to customers, to competitors, and to internal teams.

Because solutions often include many capabilities, services, and configuration options, pricing becomes more than a simple number. It is a strategic signal—to customers, to competitors, and to internal teams.

For example, packaged prices allow companies to offer broader value while lowering the overall cost compared to purchasing items independently. Target prices help salespeople focus on value rather than margin alone. Discounted prices reflect the reality that customers differ across segments and geographies. And sale prices help companies manage transitions between product generations.

Understanding how all these price types work together is essential to protecting the company from under-pricing, which erodes margins, and over-pricing, which limits competitiveness.

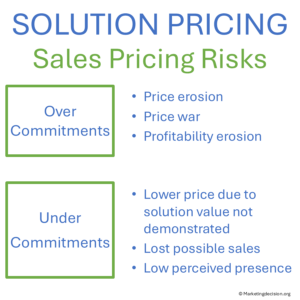

Pricing errors can occur at various points in the customer journey. Over-commitments—promising unrealistic capabilities or timelines—may lead to concessions that damage profitability and credibility. Under-commitments, on the other hand, may result in incomplete proposals, causing deals to be lost or won at unnecessarily low prices.

Pricing errors can occur at various points in the customer journey. Over-commitments—promising unrealistic capabilities or timelines—may lead to concessions that damage profitability and credibility. Under-commitments, on the other hand, may result in incomplete proposals, causing deals to be lost or won at unnecessarily low prices.

These issues must be understood and corrected. Pricing is not only about numbers; it is also about how the solution is presented, what expectations are set, and how consistent the offer remains from the first discussion to final delivery.

Maintaining control across all steps avoids recurring defects and reinforces trust across teams.

A clear distinction must be made between Price Setting and Price Getting, which are closely linked but serve different purposes and involve different teams.

A clear distinction must be made between Price Setting and Price Getting, which are closely linked but serve different purposes and involve different teams.

Price Setting is primarily the responsibility of marketing. It includes:

Price Setting occurs before the solution reaches the market, often months or years in advance. It is strategic, forward-looking, and based on expected market behavior.

Price Getting, by contrast, is driven by sales teams. It involves:

Price Getting is immediate and situational. It requires judgment and adaptability, because no two deals are the same.

These two mechanisms must reinforce each other. A well-prepared strategy is ineffective without strong field execution, and excellent field execution becomes difficult if the underlying strategy is not robust. Clear roles, transparent processes, and well-defined escalation procedures help ensure both Price Setting and Price Getting contribute to the company’s objectives.

As introduced earlier, Price Setting is led by marketing and goes far beyond defining a list price. It requires teams to anticipate how the market will respond, how customers evaluate value, and how competitors may adapt. Because price is closely connected to perceived value, understanding how customers interpret the solution is essential.

As introduced earlier, Price Setting is led by marketing and goes far beyond defining a list price. It requires teams to anticipate how the market will respond, how customers evaluate value, and how competitors may adapt. Because price is closely connected to perceived value, understanding how customers interpret the solution is essential.

One of the most effective approaches involves revisiting past and present transactions. When marketing teams analyze the performance of solutions over time, they gain insight into customer expectations, the arguments that resonated, and the conditions that made deals successful. This feeds directly into Value Pricing and prepares the ground for new offerings.

Companies can use several tools for this purpose, many of which are strengthened by close collaboration between sales and marketing. Sales teams have direct exposure to the market and are often the first to identify subtle changes in competitive messaging, customer priorities, or alternative solutions. Their observations must be handled with care—they are invaluable but can be easily misinterpreted if taken out of context.

These tools, used together, reveal the full picture of value dynamics:

Each method offers a different lens through which to interpret value, and together they support a consistent Value Pricing strategy.

Multiple approaches are available for gathering customer feedback. The simplest and most effective methods involve speaking directly to customers after a purchase has been made. These discussions—structured or informal—help clarify why customers selected one solution over another, what benefits they expected, and how well they believe the solution meets their needs.

Multiple approaches are available for gathering customer feedback. The simplest and most effective methods involve speaking directly to customers after a purchase has been made. These discussions—structured or informal—help clarify why customers selected one solution over another, what benefits they expected, and how well they believe the solution meets their needs.

Interviews with existing customers provide valuable insight for future product launches. They often reveal which arguments were most convincing and which capabilities truly mattered. They may even uncover strengths that were not initially anticipated by the company.

Interviews with competitors’ customers are more challenging to arrange but extremely valuable. They help identify how competitors frame their offers and what customers believe would persuade them to switch. Care must be taken, however: in these conversations, the focus is on understanding motivations without revealing strategic information.

A different approach involves organizing focus groups. These bring together customers with similar profiles to test arguments, explore scenarios, and provide honest opinions on value and pricing. They are often run by market research firms to ensure confidentiality and avoid biased responses. Focus groups highlight customer perceptions early in the design phase and strengthen the foundation for Value Pricing.

While interviews and focus groups provide structured insight, sales operations deliver continuous, real-world feedback. This feedback is essential to understanding how customers progress through their decision processes.

While interviews and focus groups provide structured insight, sales operations deliver continuous, real-world feedback. This feedback is essential to understanding how customers progress through their decision processes.

At the start of a sales cycle, customers may build complex spreadsheets describing all available options. Over time, however, their evaluation simplifies. By the end of the process, decisions often rest on two or three essential criteria. Identifying these key drivers is vital, as they offer clear guidance on how the company should refine messaging, pricing structures, and sales arguments.

Understanding the reasons behind won and lost deals also reveals how pricing and value perception interact. Customers may indicate that price was a decisive factor, but the truth is often more nuanced. The salesperson’s argumentation, the timing of concessions, the configuration proposed, and the perceived value of competing solutions all influence the final choice. It is essential to capture this nuance and avoid simplistic conclusions.

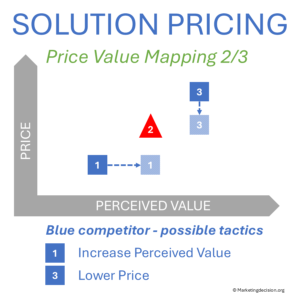

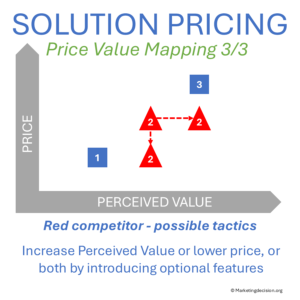

Among the most effective tools for aligning price with perceived value is the Price-Value Map. This method visualizes how customers compare solutions based on two dimensions that matter most:

Among the most effective tools for aligning price with perceived value is the Price-Value Map. This method visualizes how customers compare solutions based on two dimensions that matter most:

As mentioned earlier, value and price are distinct, but the relationship between them shapes how solutions are evaluated. The Price-Value Map helps teams understand whether a solution appears overpriced, underpriced, or fairly priced given its perceived strengths. It also helps identify differences across market segments, where expectations and priorities may shift.

While marketing teams typically use this framework to define positioning strategies, sales teams can apply it in the field to adjust configurations, refine arguments, and interpret competitive moves. The goal is not to rely on a single scenario repeatedly—competitors quickly adapt to predictable tactics—but to equip salespeople with structured insights that guide flexible decision-making.

A well-built Price-Value Map ultimately strengthens both pricing decisions and value communication. It becomes a shared language between marketing and sales.

The Economic Value Estimation (EVE) model is another essential tool supporting Value Pricing. It compares two solutions—the company’s offer and the next best alternative—and identifies differences in value by selecting financial terms relevant to the customer. These differences translate into arguments that justify price variations.

The Economic Value Estimation (EVE) model is another essential tool supporting Value Pricing. It compares two solutions—the company’s offer and the next best alternative—and identifies differences in value by selecting financial terms relevant to the customer. These differences translate into arguments that justify price variations.

EVE is valuable for several reasons:

However, EVE also has limitations. Value is not linear or additive, and customers may not evaluate each capability independently. A feature perceived as valuable by one customer may be irrelevant—or even detrimental—to another. While EVE helps highlight potential value, it must be used with judgment and accompanied by VOC insights to avoid confusing financial benefits with perceived value.

Conjoint studies offer a quantitative method to assess willingness to pay for solutions with different attributes. Common in industries such as aviation, these studies help determine how much more customers are willing to pay for specific capabilities or service levels.

While highly informative, conjoint studies require substantial data and are typically reserved for major investment decisions or high-stakes product introductions. They complement—but do not replace—qualitative methods like VOC, which remain essential for understanding customer motivations.

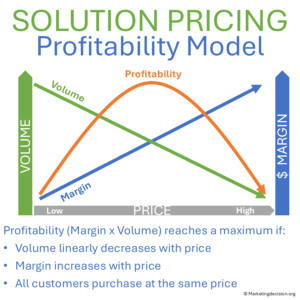

Building a price model is crucial for determining which prices should be applied across segments and how different price levels influence both volume and margin. These models typically represent:

Building a price model is crucial for determining which prices should be applied across segments and how different price levels influence both volume and margin. These models typically represent:

As price increases, volume usually decreases while margin increases. Total margin—volume multiplied by margin—often follows an inverted parabolic curve, revealing the price that maximizes overall profitability.

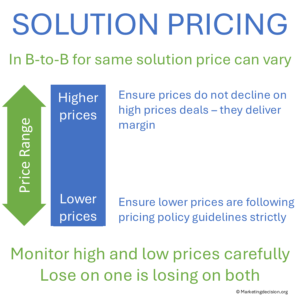

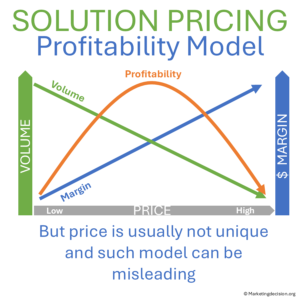

However, these models can be misleading if misused. Customer-perceived value varies not only across segments but also across individual situations. A price that is optimal on average may be inappropriate when considered on a customer-by-customer basis.

This is why understanding perceived value remains essential. A company must balance high-price and low-price deals appropriately. High-price deals support strategic positioning and allow the company to accept lower margins in other cases. Losing too many high-price deals often leads to downward pressure on all deals, weakening profitability and market presence.

As introduced earlier, Price Getting is where the pricing strategy meets the realities of the market. Sales teams must translate the broader Value Pricing approach into concrete actions for each customer situation.

As introduced earlier, Price Getting is where the pricing strategy meets the realities of the market. Sales teams must translate the broader Value Pricing approach into concrete actions for each customer situation.

Although pricing strategy provides guidance, individual transactions always involve unique circumstances. Customers compare multiple alternatives, challenge assumptions, request clarifications, and negotiate conditions. In these interactions, the salesperson must demonstrate the value of the proposed solution while adapting to customer-specific needs, constraints, and expectations.

Ultimately, each deal results in one of three outcomes—won, lost, or abandoned. To improve future performance, it is essential that the company captures insights from all situations. CRM systems play a critical role here, not only for maintaining sales forecasts but also for enabling structured reviews of what happened, why it happened, and how future offers could be strengthened.

Price Setting and Price Getting must remain closely connected. Marketing prepares the strategy, but sales teams validate it in the field, and their feedback is invaluable for refining and adjusting the approach. When communication flows effectively, the company can anticipate issues early and identify opportunities to reinforce competitiveness.

To ensure Value Pricing remains effective, companies must track pricing performance through reliable and relevant metrics. These metrics help identify where issues occur, whether they result from internal decisions, competitive pressures, or evolving customer expectations.

To ensure Value Pricing remains effective, companies must track pricing performance through reliable and relevant metrics. These metrics help identify where issues occur, whether they result from internal decisions, competitive pressures, or evolving customer expectations.

Typical metrics include:

These metrics do not simply highlight problems—they provide insight into why deals were won or lost and how pricing and value arguments performed under different circumstances. Some markets may react strongly to discounting, while in others, large discounts can undermine perceived value. Understanding these nuances strengthens Price Getting and prevents systemic pricing issues.

Occasionally, competitive strategy only becomes visible after several months. In public-sector tenders, for example, competitor bids are revealed long after the sales cycle has closed. A delayed understanding of these moves can result in repeated losses before corrective actions are taken. This underlines why continuous visibility and timely analysis are essential.

Effective sales operations require frequent communication within sales teams and across other functions. Weekly or early-week calls help teams prepare for upcoming deals, align priorities, and request specific support from marketing or pricing teams.

Effective sales operations require frequent communication within sales teams and across other functions. Weekly or early-week calls help teams prepare for upcoming deals, align priorities, and request specific support from marketing or pricing teams.

One particularly effective approach involves setting up “business rooms,” often known as “war rooms” or “win rooms.” These are short-term, high-intensity sessions where complex deals are discussed jointly by sales, marketing, and pricing teams. Their purpose is to provide timely solutions to multiple issues at once, especially when a sales team faces simultaneous challenges that could have a significant commercial impact.

These sessions must remain temporary and focused. Their purpose is not to replace existing processes but to provide rapid intervention when time-sensitive support is needed.

More companies are establishing dedicated pricing teams to support both price setting and price getting. These teams play an important role in three areas:

More companies are establishing dedicated pricing teams to support both price setting and price getting. These teams play an important role in three areas:

By reviewing pricing performance, understanding key exceptions, and identifying issues in real time, pricing teams help the organization react quickly and effectively. They capture best practices, highlight areas for improvement, and maintain a consistent discipline across all pricing decisions.

The pricing waterfall—tracking the evolution from list price to order price and finally to the sale price—is an essential tool for identifying where concessions occur. For example, a solution may be sold at the right price at order entry but later experience downward adjustments due to delivery or technical issues. Understanding these gaps ensures teams can respond without penalizing sales for factors beyond their control.

Pricing teams often collaborate with marketing to refine methodologies such as Economic Value Estimation (EVE), Price-Value Mapping, and the Voice of Customer approach. Their role is not to replace marketing, but to help ensure the strategy is applied consistently and supported by solid analytics.

Pricing teams often collaborate with marketing to refine methodologies such as Economic Value Estimation (EVE), Price-Value Mapping, and the Voice of Customer approach. Their role is not to replace marketing, but to help ensure the strategy is applied consistently and supported by solid analytics.

Their involvement in price getting also enables them to identify issues that require immediate attention in price setting. For example, if recurring patterns of price erosion are observed, pricing teams may recommend adjustments to list prices or discount rules.

Salespeople rely on the organization to support them when complex deals arise. Pricing teams can analyze such deals and provide recommendations that align with the company’s broader strategy and objectives. However, excessive escalation can weaken the natural responsibilities of marketing and sales. When every deal is escalated, the organization risks losing its pricing discipline.

Salespeople rely on the organization to support them when complex deals arise. Pricing teams can analyze such deals and provide recommendations that align with the company’s broader strategy and objectives. However, excessive escalation can weaken the natural responsibilities of marketing and sales. When every deal is escalated, the organization risks losing its pricing discipline.

Pricing teams must strike a balance—supporting key transactions while empowering sales and marketing to handle routine situations.

For most companies, pricing teams serve as a critical link across functions. They ensure that pricing processes are transparent, documented, and understood. They provide training, develop tools, and maintain visibility into pricing performance. Their value lies not in replacing existing roles but in strengthening them.

Assigning pricing teams to marketing is often the most logical structure, as pricing strategy and value communication naturally sit within marketing’s responsibilities. Aligning pricing under finance or sales can be less effective, either because it encourages excessive cost focus or because it risks eroding pricing discipline.

Profitability analysis is an essential component of Value Pricing. Pricing teams help calculate deal profitability and ensure that decisions remain aligned with customer-perceived value.

However, profitability insights must be used carefully. If sales teams receive overly detailed profitability data, they may become more cautious than necessary, offering lower prices even when a higher-margin deal could be won. The company’s long-term success depends on balancing lower-margin deals with high-margin ones, and profitability information should be interpreted in this broader context.

Lower-pricing strategies may be justified in some cases—for example, when preparing to launch a new generation of solutions with higher perceived value—but they must be applied selectively to avoid setting expectations that competitors can easily exploit.

Value Pricing connects customer perceived value, price setting, and price getting into a coherent decision loop. Addressing issues quickly, learning from deals, and anticipating competitive dynamics are all essential to protect competitiveness and profitability.

In many markets, the number one competitor becomes the reference point for all others. Holding this position is not always easy, but it provides a clear advantage: customers recognize leadership, stability, and reliability. Effective Value Pricing reinforces this leadership by ensuring that pricing decisions match customer expectations and market realities.

Ultimately, the best marketers are not necessarily the ones with the most advanced solutions. They are the ones who understand how value is perceived and who design pricing strategies that strengthen competitiveness over time.

Pricing frameworks, models, and analyses can inform choices, but they do not make decisions. At the end of the process, someone must take responsibility for setting a price, accepting its consequences, and defending it internally and externally.

Value Pricing helps structure this responsibility. It does not remove uncertainty, nor does it guarantee an optimal outcome. It supports Human judgment by clarifying trade-offs, making assumptions explicit, and linking price decisions to perceived value and strategic intent. In an AI-assisted environment, this responsibility cannot be delegated — it must be owned.

There are many useful pricing papers written by Stephan Liozu:

https://www.stephanliozu.com/papers

A recommended reading is “When Data Doesn’t Give You the Expected Answers”, which highlights how incorrect conclusions may arise from incomplete or improperly interpreted data.

Pricing clarity requires shared goals and structured decision criteria. See the Decision Mix to support value-based pricing decisions.

Willingness-to-pay ultimately stems from customer expectations and perceived benefits. For a structured overview of these drivers, see our Customer Mix chapter.

Pricing effectiveness depends on understanding how different segments perceive value and price. See our Customer Segmentation Principles page for the foundations.

Effective pricing strategies depend on a clear definition of value. To place pricing decisions into a wider context, see our Value Creation framework.

Value-based prices require strong value-selling capabilities to be understood and accepted. For more on how prices are justified through value, visit our Value Selling page.

Effective value pricing requires a clear understanding of how solutions are structured and perceived. For these foundations, see our Solution Mix page.

Value Pricing aligns prices with customer-perceived value rather than internal costs or competitor benchmarks. It connects value creation, segmentation, and pricing authority to strengthen competitiveness and profitability.

Value Pricing and Value-Based Pricing share the same foundation: prices should reflect customer-perceived value. In practice, Value Pricing, as described here, integrates not only the evaluation of value but also the distinction between price setting and price getting, the use of tools such as the Price-Value Map and EVE, and the organizational mechanisms needed to keep pricing decisions aligned with strategy. It is particularly suited to complex B2B solutions, where capabilities, service levels, and configurations all influence perceived value.

Solution businesses rarely sell a single product; they offer combinations of technologies, services, and support. In these contexts, Value Pricing helps ensure that prices reflect the benefits customers expect, rather than simply following cost-plus or reactive discounting. It reduces unnecessary price erosion, clarifies how value should be communicated, and helps companies maintain a credible positioning while meeting their profitability objectives.

Several tools support Value Pricing by clarifying how customers perceive and compare solutions. The Price-Value Map helps position offers based on perceived value and price. Economic Value Estimation (EVE) highlights financial benefits and justifies price differences. Voice of Customer approaches capture motivations and decision criteria directly from customers. Conjoint studies and profitability models add a quantitative view where needed. Used together, these tools provide a structured foundation for pricing decisions.

Sales teams are responsible for price getting, where pricing strategy is translated into concrete proposals for each customer situation. Their role is to demonstrate value, adapt offers within defined rules, and manage competitive pressure without defaulting to discounts. They also provide essential feedback: by explaining why deals were won, lost, or abandoned, they help marketing and pricing teams refine price setting and strengthen future decisions.

Value Pricing improves long-term profitability by aligning price decisions with what customers are actually willing to pay for the value they perceive. It allows companies to protect high-value deals, manage a healthy mix of margins across segments, and avoid systematic under-pricing triggered by reactive discounting. Over time, this reinforces competitive positioning, sustains investment in new solutions, and supports a credible leadership role in the market.

© marketingdecision.org

Value Pricing often represents the visible “tip of the iceberg”—a stage that follows extensive groundwork, including market analysis, customer segmentation, and the design of high-potential solutions. Pricing is where product positioning is crystallized and becomes explicit, drawing on insights from market research, segmentation, and an understanding of customer preferences.

The Price-Value Map is an essential tool for analyzing both positioning and pricing. It visually compares your solution’s price and perceived performance against competitors, helping determine whether pricing is justified by the value delivered. It also keeps teams focused on customer expectations and strengthens value-based pricing decisions by identifying pricing opportunities or competitive gaps.

The Economic Value Estimation (EVE) model is another important method. EVE quantifies the differential value perceived by customers between two solutions—typically your offering and the next best alternative. By converting value differences into monetary terms, EVE helps develop financial sales arguments tailored to customer segments and supports value selling. It clarifies where capabilities create measurable economic benefits and where they may not.

Together, these tools ensure that pricing decisions remain anchored in both market realities and customer perceptions. This combination helps teams assess how solutions compare, identify opportunities for differentiated pricing, and communicate value clearly during sales interactions. When used consistently, these methods strengthen competitiveness and support long-term profitability.

The following section may include tools, some free and some with a fee, to support this site’s development. If you believe a tool is missing and should be presented here, please contact us at: contact@marketingdecision.org

Before acquiring a solution, it is important to compare the solution’s ability to meet needs and expectations with its proposed price. The Price-Value Map is a tool that allows for the independent comparison of these two dimensions—value and price—by representing them on a graph with these two specific axes.

In the case of complex purchases, sophisticated scorecards are usually developed to evaluate and compare solutions from different suppliers. Alternatively, customers may evaluate and rank solutions based on their preferences and needs. In all cases, a perceived value is assessed, and solutions can then be compared with their price before a decision is made. This is precisely what the Price-Value Map enables.

This tool is naturally used by customers, but it is also widely employed by marketing and sales teams for various purposes. For sales, it serves as a tactical tool to assess and compare competitive offerings with their own, helping to determine sales tactics, including pricing strategies. For marketing, it provides an approach for considering long-term positioning across their own range of solutions, as well as competitive offerings for all segments served by the company.

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)