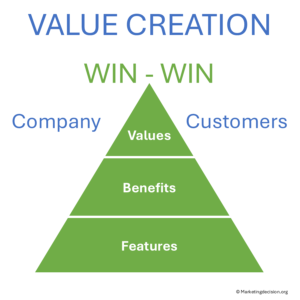

The centerpiece of solution marketing—or product marketing for some—is value creation. It represents the intersection between the company’s ambitions and customer needs, where both parties benefit.

The centerpiece of solution marketing—or product marketing for some—is value creation. It represents the intersection between the company’s ambitions and customer needs, where both parties benefit.

Creating value means investing time and effort in developing the right solutions—those that truly delight customers while strengthening company performance. This continuous effort involves assessing and maximizing the portfolio of solutions, identifying growth opportunities, and defining action plans to develop, prioritize, and launch solutions that win customers—both now and in the future.

Rather than viewing the market as an adversarial environment, where both customers and competitors are obstacles, value creation encourages a win-with-customers mindset. Companies succeed when customers perceive their solutions as the best means to achieve their own objectives.

Rather than viewing the market as an adversarial environment, where both customers and competitors are obstacles, value creation encourages a win-with-customers mindset. Companies succeed when customers perceive their solutions as the best means to achieve their own objectives.

This win-win relationship relies on alignment between customer needs, perceived benefits, and solution features—as described in the Value Ladder. When those elements fit together, customers recognize superior value and willingly choose your solutions.

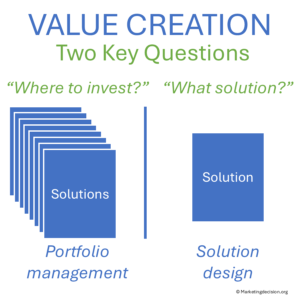

Two major questions drive this process:

Value creation does not occur in isolation. It requires alignment across functions—marketing, engineering, manufacturing, finance, and beyond. The outcome of this collaboration determines the company’s future solution offering and its competitiveness in each market.

Value creation does not occur in isolation. It requires alignment across functions—marketing, engineering, manufacturing, finance, and beyond. The outcome of this collaboration determines the company’s future solution offering and its competitiveness in each market.

There is no viable solution until value creation, value pricing, and value selling are fully aligned. Price positioning and sales approaches must consistently reflect the value that the designed solution delivers to its targeted customer segments.

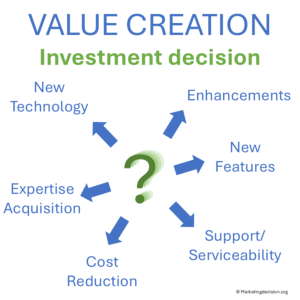

Companies have several strategic options when deciding where to invest in future solution development.

Companies have several strategic options when deciding where to invest in future solution development.

Portfolio management must encourage cohesion and collaboration across teams so that all these initiatives contribute to a shared direction.

One approach involves continuous improvement, where solutions are regularly upgraded with new capabilities or minor technological evolutions. Another approach is leapfrogging, where companies aim to create entirely new solutions that redefine markets.

One approach involves continuous improvement, where solutions are regularly upgraded with new capabilities or minor technological evolutions. Another approach is leapfrogging, where companies aim to create entirely new solutions that redefine markets.

Both have advantages and risks. Continuous improvement allows regular market communication and brand reinforcement but keeps competitors visible and customers comparing options. Leapfrogging may deliver breakthroughs, yet it demands heavy investment and long development cycles, during which competitors may close the gap.

An intermediate strategy often works best—combining ongoing solution improvements with long-term technology development, releasing new generations when ready. In every case, decisions rely on investment priorities and finite resources.

Sound investment decisions begin with the right business questions—those that link company objectives to customer and market priorities. They echo the essential “why” question introduced in the Decision chapter:

Which investments secure the best positioning now and in the future, in growing and profitable market segments?

Which investments secure the best positioning now and in the future, in growing and profitable market segments?These questions should be revisited regularly. Some investments may underperform or face delays, requiring adjustments to maintain alignment with strategic goals.

When applied to the business environment, they guide focus on the essential needs for:

Profitability – by identifying profitable segments and developing solutions that both delight customers and protect margins.

Profitability – by identifying profitable segments and developing solutions that both delight customers and protect margins.Ultimately, the goal is sustainable, profitable growth, achieved by maintaining a clear focus on priorities and allocating resources to the most promising opportunities.

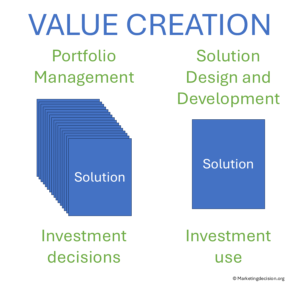

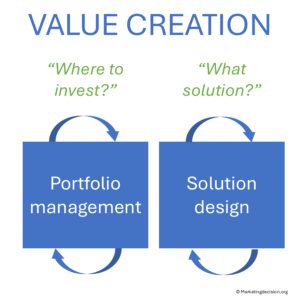

Value creation depends on the coordinated work of multiple teams. To ensure structure and efficiency, it is practical to organize it into two complementary processes:

Value creation depends on the coordinated work of multiple teams. To ensure structure and efficiency, it is practical to organize it into two complementary processes:

Portfolio management facilitates investment decisions and budget allocation, while solution design transforms those investments into tangible offerings. When both processes are well connected, the organization can adapt quickly and make informed choices on priorities and trade-offs.

For additional perspectives, you may consult this article from IMD: How to Write a Value Proposition.

Solution design and development fall under the domain of product/solution teams, who are responsible for creating solutions and contributing to portfolio management discussions.

Designing solutions can be a lengthy process, and management techniques along with QMS (Quality Management Systems) provide guidelines for solution development. These tools are fundamental and can be used by teams to articulate their program development, but they are not covered in detail on this website. For more information, please consult dedicated sites such as: ISO 9001 Help: ISO Templates.

For details on product development phases, various sites offer recommendations on organizing product development, from the early phases where product concepts are considered, to when prototypes are developed, validated, manufactured, and then delivered and serviced. See the following resources: New Product Development – Wikipedia and Lean Product Development – Wikipedia

Portfolio management is at the core of value creation. It defines how companies decide where to invest and how to balance short- and long-term priorities. By establishing consistent review mechanisms, teams across functions can remain coordinated and transparent in their decision-making.

Portfolio management is at the core of value creation. It defines how companies decide where to invest and how to balance short- and long-term priorities. By establishing consistent review mechanisms, teams across functions can remain coordinated and transparent in their decision-making.

The tools presented in the Decision chapter—together with those outlined below—help structure these discussions, improve collaboration, and prepare the company to develop, deliver, and support solutions that win in the marketplace.

Value creation is a continuous process. Each review leads to new projects being launched, refined, or sometimes discontinued. These investment decisions shape future offerings and strengthen the company’s ability to grow profitably and sustainably.

Value creation always begins with understanding distinct customer segments. For segmentation foundations, refer to Customer Segmentation Principles.

Value creation starts with understanding customer needs and motivations. For this essential perspective, see our Customer Mix chapter.

Translating created value into price requires a structured approach. To place these ideas into a wider pricing context, visit our Value Pricing page.

Value creation becomes meaningful when sales teams can convey it clearly. For structured approaches to communicating and defending value, refer to our Value Selling page.

Value creation decisions are part of a broader solution logic. See our Solution Marketing chapter for the overall framework.

© marketingdecision.org

The methods and tools presented in this section are essential for value creation and for evaluating how value is perceived by customers at every stage. The Price Value Map, for example, is a critical tool for product teams considering new products or configurations for different market segments. This tool provides a clear visualization of how customers perceive the performance and price of your products compared to competitors, helping teams identify pricing opportunities and competitive positioning.

The Price Value Map is especially valuable for sales teams working on complex offerings, where customer decision cycles may take months. It allows teams to map solutions—both from your company and from competitors—for specific customers, making it indispensable for large and complex deals.

Given the multifunctional nature of teams involved in value creation, a variety of techniques can be beneficial. Lean Six Sigma approaches, such as value stream mapping, emphasize quality and process improvement from product inception to development, helping to align internal processes with customer value. Quality Function Deployment (QFD) is another valuable tool, translating customer needs into features and characteristics while considering costs for optimal market positioning.

Additionally, consider using scorecards and comparison tools to assess solutions and capitalize on market risks and opportunities. These approaches ensure that your solutions remain competitive and can potentially displace previous generations of products when introduced to the market.

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

The strategic Position Analysis Tool is an effective approach to analyze and discuss both current and future offerings in comparison to the market. Many solutions may be conceived, but which ones will be better positioned to succeed in the market place? And which will enhance competitiveness? This is the objective of the Strategic Position Analysis tool.

Current or future solutions can be mapped along two axes: “ability to compete” and “market attractiveness.” Solutions can be compared for their market fit as well as their strength relative to the competition. Teams can evaluate the various options available and discuss which solutions are more aligned with company objectives, enabling better allocation of limited investment budgets.

Portfolio management involves making decisions about the company’s investment budget and allocating different budget lines to the development of solutions and the technology components that make up those solutions. It can also include investments in sales and service, for example, when the goal is to expand into new market segments that require specific sales and service infrastructures.

Therefore, portfolio management is not limited to products or solutions; it also includes technology and other resources required to deliver new solutions to the market. All aspects requiring investment—whether material or immaterial—should be considered. The evaluation of return on investment should broadly include all activities essential for introducing a solution to the market.

Portfolio management is a core activity where a company evaluates its approach to solutions development and makes both short- and long-term investment decisions. By establishing consistent mechanisms, teams from various business functions can stay coordinated and collectively make key decisions.

A portfolio graph is a tool that displays solutions from the company—and sometimes from competitors—along a vertical axis representing the relative value of each solution. Different graphs are created for different market segments, where perceived value varies, and offerings are listed to highlight positioning and sales tactics.

This approach emphasizes value mapping. By comparing the relative values of solutions, the goal is to facilitate discussions on how each solution’s value and positioning should be addressed, both within the company’s offerings and against competitors. While price ranges can be mentioned on the graph, the vertical axis should focus on perceived value, not price, to ensure discussions stay centered on value.

This tool is particularly effective for marketing to demonstrate how company solutions compete with those of competitors in various market segments. It enables collaborative discussions between Marketing and Sales teams on sales arguments and positioning strategies.

EVE – Economic Value Estimate is an effective tool for evaluating and comparing two solutions, helping to develop sales arguments based on selected financial terms and customer benefits that differentiate these solutions. Specifically, it provides the capability to compare the value delivered to customers from the same market segments and to consider the associated financial benefits. For sales and marketing, this approach is valuable for assessing the most effective financial sales arguments in various sales situations.

EVE is complementary to and distinct from Price-Value Mapping (PVM). While both methods consider value, they have different objectives. PVM maps price as a comparison of value, whereas EVE helps decode sales arguments—particularly financial ones—to recommend a solution to a customer. It contrasts price with financial benefits. Both methods have their advantages and are worth utilizing in marketing and sales.

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)