In the realm of market analysis, there are renowned tools and methods developed by companies like BCG and General Electric that focus on evaluating a company’s market presence across various segments. These Market Presence Analysis tools leverage market growth, market share, and other relevant information to provide insights into the company’s positioning and strategic potential.

It is key to consistently question and assess the notion of market presence. Is the company actively engaged in growing market segments? Are investments being made in the right areas? Where should marketing communication and promotion costs be allocated for optimal results?

While these tools may appear highly strategic, catering to long-term perspectives, they also serve as invaluable aids in facilitating discussions and enhancing visibility within a business context.

Enhanced visibility of market size, trends, and the company’s share through simplified and clear graphical representations.

Enhanced visibility of market size, trends, and the company’s share through simplified and clear graphical representations.To conduct an effective Market Presence Analysis, start by consolidating market and company data, including growth rates, segment sizes, and indicators of competitive strength. Use the BCG and GE-McKinsey matrices to visualize company positioning across segments, or integrate these insights with the Market Share & Winds model for a deeper, data-driven understanding.

This approach transforms market presence from a static observation into a dynamic decision-making framework.

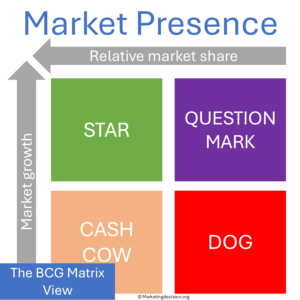

The BCG matrix is a classic tool that provides a comprehensive overview of different market segments, enabling an understanding of their growth potential and relative market share. This information is highly influential in making strategic decisions. A segment that demonstrates both growth and a high market share, resulting in lower manufacturing and delivery costs, is considered an advantageous position.

The BCG matrix is a classic tool that provides a comprehensive overview of different market segments, enabling an understanding of their growth potential and relative market share. This information is highly influential in making strategic decisions. A segment that demonstrates both growth and a high market share, resulting in lower manufacturing and delivery costs, is considered an advantageous position.

For more detailed information on the BCG matrix, you can refer to:

Website: https://www.professionalacademy.com/blogs/marketing-theories-boston-consulting-group-matrix/

Article: https://www.bcg.com/fr-fr/publications/2014/growth-share-matrix-bcg-classics-revisited

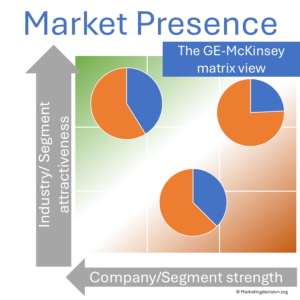

Similar approaches have been developed by other organizations, and the GE–McKinsey matrix offers a robust, more nuanced perspective on portfolio analysis and strategic prioritization. Unlike the BCG matrix’s simple four-quadrant structure, the GE–McKinsey framework uses a three-by-three grid to evaluate each business unit or initiative based on industry attractiveness and competitive strength, with greater flexibility to incorporate multiple underlying factors for each axis, such as market size, growth, profitability, competitive intensity, brand equity and distribution capabilities.

Similar approaches have been developed by other organizations, and the GE–McKinsey matrix offers a robust, more nuanced perspective on portfolio analysis and strategic prioritization. Unlike the BCG matrix’s simple four-quadrant structure, the GE–McKinsey framework uses a three-by-three grid to evaluate each business unit or initiative based on industry attractiveness and competitive strength, with greater flexibility to incorporate multiple underlying factors for each axis, such as market size, growth, profitability, competitive intensity, brand equity and distribution capabilities.

Ideally, share is represented on the graph in a way that each bubble gives a clear, comparative view of both your own position and competitors’ positions within the same market context. This means you can plot not only your relative share but also assess it against other players to enrich strategic discussions and investment decisions.

You can find an insightful overview at: https://www.professionalacademy.com/blogs/marketing-theories-ge-matrix/

Market share measures numerical dominance within a segment, while market presence reflects a company’s visibility, influence, and sustained engagement across markets.

A strong market presence can exist even with moderate share when the company holds strategic positions in high-growth or high-technology segments.

This distinction helps companies identify opportunities that are not immediately visible through quantitative share alone.

Creating these matrices can be a complex task. Defining market attractiveness, determining it, and evaluating company strength within segments all pose challenges.

Creating these matrices can be a complex task. Defining market attractiveness, determining it, and evaluating company strength within segments all pose challenges.

Initially, you can draw on your market knowledge to construct these matrices.

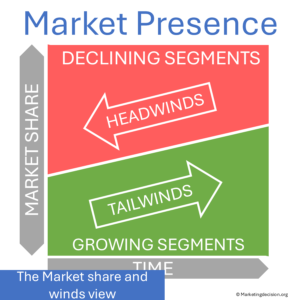

The Market Share & Winds model offers metrics across segments, including segment growth and company share within those segments.

A third dimension accounts for segment size and/or the company’s size within that segment.

With these dimensions, you can address critical questions:

A graph generated by the Market Share & Winds tool, featuring two axes representing company share and segment growth (with bubble size indicating company volume), provides a valuable visualization approach.

For more advanced representations, consider combining market segment size and growth on the vertical axis. A segment is genuinely attractive if it boasts a considerable size and substantial growth. Finally, you can use market share to determine the bubble size.

In summary, leverage your market data consolidation to assess these matrices. Graphics can be easily adjusted to depict market segment criteria as two-dimensional axes.

These frameworks provide complementary ways to evaluate a company’s market presence, from portfolio balance to dynamic growth potential.

Primary focus: Market share vs. growth

Primary focus: Market attractiveness vs. business strength

Primary focus: Share, growth, and segment dynamics

Data basis: Quantitative

Data basis: Quantitative + Qualitative

Data basis: Quantitative

When to use: When assessing portfolio balance

When to use: When evaluating multi-factor environments

When to use: When analyzing ongoing market presence and momentum

In summary, each framework offers a different perspective for evaluating market presence. The Market Share & Winds model extends traditional matrices by incorporating market segment dynamics with evaluation of tailwinds and headwinds, providing a more visual and actionable approach to decision-making.

Here an excellent article comparing these two tools: BCG tool and GE Matrix models — a must-read:

https://www.linkedin.com/pulse/mckinsey-ge-mapa-model-vs-bcg-paulo-brandao-mba-cfe/

The GE matrix model may seem more complex to develop, especially since axes are not directly related to metrics easily measurable. Its interest lies in the flexibility it provides to include hypotheses that cannot be measured but can be assessed, such as emerging new technologies.

With that perspective, the GE model’s key benefit is to ask two essential questions representing the two axes of the graph:

Why is this segment attractive? What are my strengths in this segment and can I grow them?

Here is another excellent article about the BCG matrix, easy to read and with examples: https://www.investopedia.com/terms/b/bcg.asp

The value of the BCG matrix lies in the simplicity of its calculation (although this can be a rearview mirror perspective if assessment for the future is solely based on past trends).

It questions companies on how to improve their competitive situation in market segments.

It encourages management to consider where to invest to improve competitive presence and grow faster on growing segments.

Profitability remains a key parameter to keep visible throughout these discussions.

If your offering in a “dog” segment is highly profitable, you may wish to maintain a presence there.

Read also: Comparison and Usage of the Boston Consulting portfolio and the McKinsey portfolio by Bäuerle M., Görne J. —

https://fr.scribd.com/document/464678804/Comparison-and-Usage-of-the-Boston-Consulting-portfolio-and-the-McKinsey-portfolio-Maximilian-Bauerle

These views focus on facilitating decision-making regarding capital investments. However, they can also be leveraged to understand the company’s relative strengths and weaknesses in the market.

These views focus on facilitating decision-making regarding capital investments. However, they can also be leveraged to understand the company’s relative strengths and weaknesses in the market.

This perspective is particularly beneficial for Sales and Marketing managers, as it provides clarity on short-term and long-term priorities.

Presence metrics gain depth when interpreted alongside customer motivations and expectations. For a broader perspective, visit our Customer Mix page.

Presence indicators are easier to interpret when connected to market structure and competitive forces. Visit the Market Mix page for the underlying market dynamics.

© marketingdecision.org

One of the most effective tools for assessing market presence is the Market Share and Winds tool. Using the same tool across different strategic questions is advantageous, as it streamlines data collection efforts even if the intended use varies. For example, you might use it to understand emerging market trends and new opportunities, or to analyze where the company is currently succeeding and why.

For a deeper analysis of market presence, tools like Strategic Position Analysis can be used effectively to represent market segments in a way similar to the BCG Matrix. In this configuration, the horizontal axis represents relative market share, the vertical axis shows the relative growth of each market segment, and the bubble size reflects the size of the market segment. This visual representation makes it easier to structure and enrich strategic discussions. This approach helps identify key insights and best practices, making it easier to replicate success in other areas.

Comparing local presence across markets not only highlights strengths and opportunities but also supports the development of targeted strategies for growth and competitive differentiation. Leveraging these analytical tools ensures a comprehensive understanding of your company’s position and helps inform data-driven decisions for future market initiatives.

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

A deep understanding of the market environment and trends can provide invaluable insights into overall business activities and competitive dynamics. These insights play a crucial role in addressing key business questions with a significant impact for any company.

This Excel product with macros is specifically designed to facilitate ongoing market trend analysis and comparative assessments for a company in relation to your estimated market. It offers up to seven graphics for in-depth analysis and effective communication of key insights. This product is available in three versions.

The Excel-based Strategic Position Analysis Tool is designed to compare projects by providing a clear visual method to assess, discuss, and prioritize initiatives.

It can be used effectively to represent market segments in a way similar to the BCG Matrix. In this configuration, the horizontal axis represents relative market share, the vertical axis shows the relative growth of each market segment, and the bubble size reflects the size of the market segment. This visual representation makes it easier to structure and enrich strategic discussions.

Segments positioned further to the right indicate a stronger market share position. Segments higher on the chart represent growing—and therefore potentially attractive—market segments. Bubble size becomes a powerful indicator of actual market size during strategic discussions.

The tool allows you to:

This practical visualization tool supports informed discussions and helps prioritize actions that align with your company’s strategic objectives.

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)