Forecasting the market goes beyond numbers—it’s about shedding light on the future, aligning teams around a shared vision, and preparing to seize opportunities when they appear.

Developing a precise, documented, and agreed-upon market forecast is a crucial marketing action. Estimating future market segments helps in planning for growth and setting targets by segment.

When done well, market forecasting supports aligned and effective activities across all functions. However, poor quality and lack of trust in the forecast can become a headache, leading, for instance, to underperformance in a market that is growing faster than anticipated, with sales and other functions struggling to adapt to the changing environment.

Market forecasting lies at the heart of many business decisions, but it is neither the starting point nor the final step. It is part of the effort to optimize investment decisions, from technology and product development to marketing budget allocation, sales organization, and sales compensation plans.

Accurate market forecasting requires a collective effort, a continuous process, and clear ownership and roles. It involves both qualitative and quantitative approaches to understanding market dynamics and making informed projections.

By implementing a strong forecasting culture and utilizing appropriate tools, businesses can enhance decision-making processes and gain a competitive advantage in the market.

Forecasting serves as a baseline for business decisions. In an ideal world, it helps determine future growth opportunities, guiding investments where markets are expected to expand and reducing focus where they are likely to decline. The best opportunities are identified and refined over time. This requires not only identifying growing market segments but also aligning resources and teams to outperform the competition.

Forecasting can sometimes feel like looking in the rearview mirror, where future markets are estimated based on past events repeating themselves. In reality, few factors can guarantee that future forecasts will be entirely accurate or precise. Ensure Market Visibility captures not only the present but also a meaningful record of past dynamics.

By adopting this approach—reviewing methodologies and past assumptions—new forecasting models can be built more effectively. Forecasting is both an art and a discipline, requiring teams capable of assembling forecasting paradigms and developing future estimates. These estimates provide business decision-makers with a foundation to either accept or challenge projections, ultimately aligning teams on a shared trajectory that integrates market insights with company objectives through a comprehensive 360° market analysis. Review the Market Mix chapter for more on this topic.

Multiple tools are used to analyze the market and identify new opportunities. Frameworks such as PESTLE Analysis and Porter’s Five Forces help shed light on market dynamics. However, these tools alone are not sufficient for generating numerical forecasts that serve as a baseline for decision-making.

Additional tools should be considered. Quantitative tools focus on actual data sets available from various internal and external sources. Qualitative tools aim to interpret events and their potential impact on market evolution. A third approach, scenario planning forecasting, helps address uncertainties by allowing multiple scenarios to be explored, each with its own market forecast estimates.

Forecasting involves various factors of differing nature. Some factors are not precisely known but may still have an impact, requiring qualitative assessments. Expertise and internal evaluation help gauge their potential effects.

Other factors, such as inflation, GDP, consumer indices, or industry estimates, are quantifiable and can be incorporated into forecasts. These elements play a significant role in quantitative forecasting.

These two approaches—qualitative and quantitative—are not independent and should be combined for maximum effectiveness. They help construct scenarios that consider both perceived events with positive and negative impacts and key measurable factors that provide a baseline for market evaluation.

By integrating qualitative and quantitative methods with scenario planning, businesses can explore multiple strategic approaches, assess their potential impact, and determine the best course of action. Scenario planning is particularly valuable for fostering discussions on risk and opportunity management.

Qualitative forecasting focuses on identifying factors that influence market growth and decline.

While working with qualitative sources can be challenging, many of the identified factors have historically influenced the market for years. Analyzing their past impact provides valuable insights into their potential effects in the future.

These factors often extend beyond the company’s performance, shaping the entire industry.

Although qualitative factors may seem difficult to quantify, their impact can be estimated. For instance, a government initiative can be assessed for its short-term, medium-term, or long-term effects.

The challenge in qualitative forecasting lies in ensuring that the findings are thoroughly discussed and properly moderated. Leveraging the expertise of multiple domain specialists is essential. Key insights from different teams should be consolidated into a market drivers summary to guide decision-making.

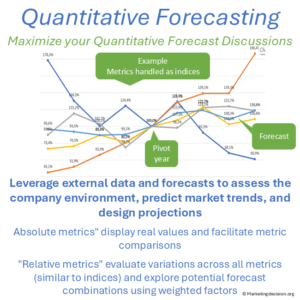

Quantitative forecasting relies on existing market forecasts, such as those from FMI, OECD, or industry associations (public or private). The fundamental assumption is that market behavior is influenced by multiple economic variables, which can be combined into an index that best represents the market being analyzed.

Quantitative forecasting relies on existing market forecasts, such as those from FMI, OECD, or industry associations (public or private). The fundamental assumption is that market behavior is influenced by multiple economic variables, which can be combined into an index that best represents the market being analyzed.

While using such an index is effective and straightforward, it is essential to maintain a critical mindset. Complementary approaches, such as qualitative analysis and scenario planning, provide additional insights that can refine the forecast.

Although quantitative models may be subject to scrutiny, external forecasts often serve as valuable benchmarks. Comparing current forecasts with those from previous years can be useful, but it does not serve as proof of forecast accuracy. Instead, it provides context for understanding market evolution.

Relying on a single, detailed forecast when building a business plan can create a misleading sense of certainty. Despite their structured appearance, forecasts are ultimately predictions—and market conditions can change unexpectedly, potentially making a well-crafted business plan obsolete.

Scenario planning forecast addresses this uncertainty by considering alternative market conditions and assessing how the business should adapt. Each scenario represents a specific set of events and market conditions, each with its own implications.

The goal of scenario planning is to enhance business resilience by ensuring that the plan is adaptable to different situations. By incorporating this approach, organizations can improve risk management, seize new opportunities, and build a more agile response to market changes.

Read more about Scenario planning forecasting.

The need for a market forecast is unquestionable, but defining what makes a good forecast is essential for teams to optimize their approach. Forecasting requires a significant investment of time and resources, including potential costs for external studies.

Beyond technical complexity, human factors play a crucial role in the process.

A good forecast is one that is trusted and well-utilized. This trust can be built in several ways:

Forecasting is an ongoing, multi-year process that improves over time. It involves cross-functional teams and is an integral part of marketing planning and business operations.

There are great articles about forecasting and this Wikipedia article includes a very comprehensive description:

Wikipedia on Forecasting

Besides the qualitative and quantitative approaches mentioned here, additional methods—such as expert interviews—are often used by large corporations. These interviews complement qualitative approaches and can be combined with PESTLE analysis or Scenario Planning.

However, interviews may follow patterns and create a false sense of certainty. Include them within a structured PESTLE or scenario analysis to maintain objectivity.

A recommended article offering strong perspective on market forecast dimensions:

Market Forecast Article by CopyPress

For sales forecasting practices, Anaplan’s forecasting guide provides additional insights.

Another good read from HBR shares advanced methods for effective forecasting:

Harvard Business Review – Six Rules for Effective Forecasting

And yes, beware of forecasts made from looking in the rear mirror!

Internal dynamics within a company can create challenges for forecasting. For example, the sales department may prefer a conservative forecast to set achievable targets.

To navigate these challenges effectively, it is essential to engage teams early in the process and integrate both qualitative and quantitative approaches. Scenario planning forecasting should also be incorporated into the final business plan to ensure adaptability.

Collaboration across functions is key. Engaging multiple teams allows for a more comprehensive view, ensuring that insights and estimates are challenged where necessary. If time is limited, prioritize the factors that have experienced significant recent changes and hold the greatest potential impact.

Forecasting accuracy improves when grounded in a strong understanding of customer needs and behaviors, as outlined in our Customer Mix chapter.

Forecasting becomes more reliable when based on clear market drivers. Visit the Market Mix page for the structural factors that guide forecasting.

A market forecast is an estimate of future market size or growth, based on both quantitative data (economic indicators, industry reports) and qualitative insights (expert opinions, scenario analysis). It supports strategic decisions in marketing, investment, and resource allocation.

Qualitative forecasting relies on expert judgment and contextual analysis, while quantitative forecasting uses quantifiable data such as GDP, inflation, or industry indices. The most effective forecasts combine both approaches.

Scenario planning forecasting helps businesses prepare for uncertainty by exploring multiple possible market outcomes. It improves resilience and supports agile strategic responses.

Improving forecast accuracy requires clear ownership, reliable data sources, and consistent review of assumptions. Combining qualitative and quantitative methods, and comparing past forecasts with actual performance, enhances credibility and precision.

A good forecast is collaborative, transparent, and continuously refined. It’s trusted because it integrates multiple viewpoints, clear data validation, and alignment with business goals.

© marketingdecision.org

Good forecasting—both qualitative and quantitative—is the result of evaluating multiple data sources and consolidating them. Various techniques are employed to remain attentive to both small and large market signals.

Forecasts should be applied carefully: first, to assess the market, and then to determine a company’s responses to estimated market evolution, including appropriate solutions and their promotion.

This also involves creating a forecast culture where individuals feel proud of participating in and contributing to market 360°, Porter’s forces evaluation, PESTLE analysis, and various other forms of Market Research.

The tools proposed here help address the two main categories of forecasts: qualitative and quantitative. There are many other approaches that can be considered, and these methods should help you identify your own preferred approaches.

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

Qualitative forecast is essential to address topics that are not easily measurable. Sales, Marketing, Quality and other functions working with customers can provide valuable inputs for qualitative forecasting.

Qualitative forecast is essential to address topics that are not easily measurable. Sales, Marketing, Quality and other functions working with customers can provide valuable inputs for qualitative forecasting.

This Excel tool can be utilized across multiple instances with various teams. Its primary purpose is to document events, assign probability of occurrence, and evaluate their impact on a scale ranging from 0 to 9. This structured approach facilitates productive discussions within the teams. The tool also provides a graphical representation with multiple options.

Quantitative forecasting leverages existing market forecasts such as those prepared by FMI, OCDE or other associations (public or private), the assumption is simply that the market is a function of multiple variables, usually economical, that can be combined for an index that best represent the considered market.

Quantitative forecasting leverages existing market forecasts such as those prepared by FMI, OCDE or other associations (public or private), the assumption is simply that the market is a function of multiple variables, usually economical, that can be combined for an index that best represent the considered market.

By providing both Absolute – real values – and Relative Metrics – index resulting from indices variations – this tool offers a comprehensive perspective of your quantitative data, allowing for a more nuanced analysis useful for more informed business decisions.

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)