Selecting the right channel strategy is a key decision with long-term impact. Multiple sales and distribution channels can be considered — direct, indirect, e-commerce, or via dealers and distributors — either one at a time or simultaneously. Each brings different advantages and disadvantages in terms of cost, flexibility, and capability to address all targeted customer segments.

Selecting the right channel strategy is a key decision with long-term impact. Multiple sales and distribution channels can be considered — direct, indirect, e-commerce, or via dealers and distributors — either one at a time or simultaneously. Each brings different advantages and disadvantages in terms of cost, flexibility, and capability to address all targeted customer segments.

A well-defined channel strategy supports the overall Go-to-Market approach and ensures that sales efforts are aligned with company objectives. Channel strategy helps teams decide how to reach customers effectively, consistently, and profitably. Each channel should be carefully evaluated, and when possible, new channel solutions should be tested and validated before full deployment.

Beyond defining how products reach markets, a channel strategy should clarify why certain paths are chosen and how they serve the company’s broader objectives.

Each organization must ask: What are we trying to achieve through our channels? Are we seeking growth, reach, efficiency, or customer intimacy?

Once these strategic intentions and business questions are clear, the what (choice of channels and structures) and the how (processes and optimization) can be addressed with greater focus and consistency. This logical path—from why to what to how—defines an effective approach to channel optimization.

Channel initiatives must start with a benchmark to evaluate the current organization and consider the advantages and disadvantages of a change in structure.

Some strategies may pose serious risks — for instance, losing control over the customer base. This is particularly relevant when working with agents who act as independent sales representatives and, in many countries, hold rights to their customer relationships.

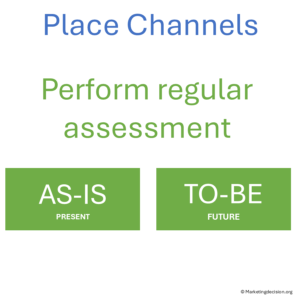

Assessing the current channel setup (AS-IS) helps teams identify what works and what may need adjustment before designing alternative distribution solutions.

For a direct sales organization, multiple roles may be considered to support sales activities. Some roles are technical, such as product experts who can best articulate product benefits, while others require financial and commercial skills to close deals.

In technical businesses, several roles may contribute simultaneously to the sales discussion and deal closure. Additionally, direct sales may be structured by customer segments, product categories, or market regions, depending on the company’s objectives and coverage requirements.

Indirect sales organizations often provide the advantage of an existing salesforce that can quickly ramp up to support your activity, reaching more customers faster than a direct organization could.

Indirect sales partners bring valuable expertise, leveraging their networks, logistics, and service capabilities to support sales operations in markets or segments that might otherwise be difficult to access.

However, these organizations also present disadvantages. Their sales teams are often active for multiple companies and may prioritize others if compensation schemes are more attractive. Indirect organizations may also be less effective for complex or high-technology products that require multiple customer visits or technical expertise.

In many cases, a combination of indirect distributors and a direct team of specialists can deliver the best results — distributors provide reach and flexibility, while direct teams ensure technical depth and consistent messaging.

Although distributors may appear more costly than a direct sales organization, they bring critical benefits such as speed, adaptability, and extended market coverage.

E-commerce is an essential channel for many markets and customer types. Beyond online catalogs or product pages, digital channels can deliver technical content, testimonials, and demonstrations that build confidence and simplify purchase decisions.

In some markets, developing multiple e-commerce channels may be relevant, especially when serving different customer segments with distinct needs and price points. Digital channels also provide valuable insights into buying behavior and customer preferences — essential for refining the overall Go-to-Market strategy.

When defining a channel strategy, it is essential to distinguish between multichannel and omnichannel approaches:

When defining a channel strategy, it is essential to distinguish between multichannel and omnichannel approaches:

An effective channel strategy often evolves from multichannel to omnichannel as systems, data, and customer management processes mature.

Revisiting your channel strategy starts with the same reflection raised in the introduction: Why do we operate through specific channels? What goals are we pursuing, and how do these choices serve our overall Go-to-Market direction?

Once these reasons are clear, the following business questions help translate them into actionable criteria for optimizing sales and distribution performance:

These questions are fundamental to assessing the effectiveness of any Go-to-Market model. Whether managing direct or indirect channels, transparency, measurable performance, and regular evaluations are essential to maintain control and partnership alignment.

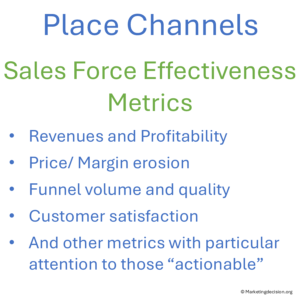

Several sales and distribution metrics are essential to support these evaluations, and they vary by business type. Common indicators include:

Several sales and distribution metrics are essential to support these evaluations, and they vary by business type. Common indicators include:

Such metrics are often visualized using waterfall charts, both at market and individual salesperson levels. These charts illustrate the total market, the addressed market, the CRM-reported pipeline, and the orders won.

Additional indicators may include differences between orders and actual sales, as order cancellations and concessions can significantly impact financial performance.

Clear metrics not only enhance internal decision-making but also support mutual understanding in distributor partnerships, strengthening cooperation and accountability.

Identifying alternative approaches to the current Go-to-Market structure requires a clear assessment of the existing situation — the AS-IS.

Identifying alternative approaches to the current Go-to-Market structure requires a clear assessment of the existing situation — the AS-IS.

For new products or markets, the AS-IS may be limited or hypothetical. In such cases, benchmarking competitors can provide valuable insights and serve as a reference.

Once the current baseline is defined, multiple future-state (TO-BE) scenarios can be evaluated. Each scenario should be compared across common criteria such as efficacy, flexibility, reach, and capability to address both short- and long-term needs.

Scorecards are particularly effective tools for comparing these scenarios objectively, helping decision-makers visualize trade-offs and prioritize the most promising models.

There are numerous valuable resources on the topic of sales and distribution channels available online. The following provide relevant insights and definitions:

There are numerous valuable resources on the topic of sales and distribution channels available online. The following provide relevant insights and definitions:

Together, these resources expand on the definitions and practical applications of various channel strategies, illustrating how distribution models influence both customer relationships and operational performance.

At least once per business-planning cycle, the company’s Go-to-Market and channel strategy should be reassessed.

Evaluating how well the chosen model supports customer coverage, profitability, and flexibility helps ensure alignment between marketing, sales, and corporate objectives.

Building robust sales metrics and regularly comparing AS-IS and TO-BE scenarios enable better-informed decisions and a clearer understanding of market opportunities and organizational performance.

Channel strategy often varies with market fragmentation and competitive structure. See Market Mix for the structural context influencing placement choices.

Effective channel decisions must align with customer buying behaviors and preferences. For this essential understanding, visit our Customer Mix page.

Channel design becomes clearer when anchored in your broader placement model. Refer to Place Mix Strategy for the overall framework.

© marketingdecision.org

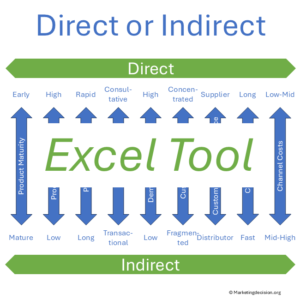

The Direct vs Indirect Tool provided here supports evaluation and comparison of different distribution models. Each organizational structure offers distinct advantages and disadvantages, and Scorecards, as discussed above, can help compare options objectively.

Additionally, applying Porter’s Five Forces Analysis can offer an external view by considering competitive dynamics and channel power.

The following section may include tools, some free, some with a fee to support this site development. If you believe other tools should appear in this section, please contact us at contact@marketingdecision.org.

When investing in a marketing decision regarding direct or indirect channel distribution, multiple questions may arise and require team discussion. Which is preferred? Indirect distribution for ease of deployment once a partner is identified? Or direct distribution to gradually invest in a market and learn about customer needs and preferences?

When investing in a marketing decision regarding direct or indirect channel distribution, multiple questions may arise and require team discussion. Which is preferred? Indirect distribution for ease of deployment once a partner is identified? Or direct distribution to gradually invest in a market and learn about customer needs and preferences?

The proposed Excel tool can support discussions and evaluations of criteria to guide a decision between these two approaches. Choosing between direct and indirect operations commits the company to long-term engagements.

This tool is designed to facilitate a structured discussion among team members. By addressing one topic at a time, the discussion can focus on the strengths and weaknesses of different solutions.

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)