The Economic Value Estimation (EVE) model is an effective approach for comparing two solutions and identifying the value drivers that differentiate them. It helps marketing and sales teams articulate financial arguments and customer benefits that support value-based selling strategies. By contrasting perceived value with measurable financial benefits, the EVE model enables organizations to refine their value propositions and strengthen sales discussions within specific customer segments.

EVE complements the Price Value Map (PVM). While both methods focus on value, they serve distinct purposes. PVM visualizes how customers perceive value relative to price across solutions. EVE, on the other hand, decodes the financial rationale behind customer preferences, contrasting price with the economic benefits customers gain. Both perspectives are valuable and reinforce each other when positioning solutions and shaping commercial arguments.

Economic value estimation helps teams compare options and frame pricing discussions — not calculate a “right” price.

When comparing two solutions — whether from the same company or competing offers — EVE helps explore two key dimensions: perceived value and financial benefit.

When comparing two solutions — whether from the same company or competing offers — EVE helps explore two key dimensions: perceived value and financial benefit.

The central questions are:

What is the relative perceived value of these two solutions?

Which features contribute most to this perception, and why?

What financial benefits do customers derive from these features, and how can these insights strengthen pricing and sales arguments?

Although the model appears quantitative, EVE remains fundamentally interpretive. Customer perceptions differ, even within a single segment, and financial evaluations depend on how customers use the solution. Recognizing this subjectivity is essential for interpreting results and transforming them into relevant sales insights.

EVE is often used to evaluate enhancements between an existing solution and its successor, or to benchmark offerings from different companies. By examining customer-perceived value and financial benefits in parallel, teams can identify where differentiation truly lies.

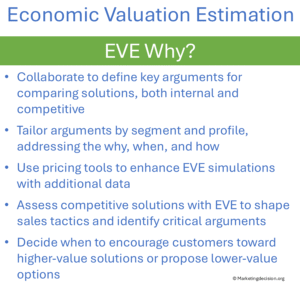

This process is particularly valuable when marketing and sales teams work together to interpret results. Joint analysis leads to clearer positioning choices, better-prepared pricing discussions, and sharper value communication. It also encourages forward-looking thinking about how upcoming improvements can strengthen the company’s competitive advantage.

EVE analysis brings together marketing, sales, and sometimes customers to evaluate how features influence both perceived and financial value. This dialogue often reveals variations in perception: some participants see benefits as significant, while others find them marginal or even negative. These differences are informative, showing how diverse customer needs shape solution preference and pricing sensitivity.

When designing a new version of a solution, EVE provides a disciplined way to assess which features have the greatest potential impact. By simulating comparisons against competitors, teams can anticipate market reactions and adjust development priorities. Involving sales representatives in this process ensures findings are directly translated into effective sales arguments and scenarios.

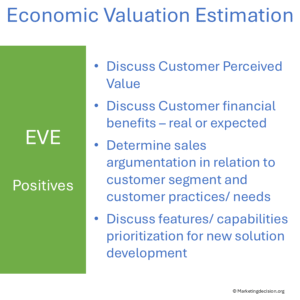

The EVE model provides a structured way to connect customer-perceived value, financial benefits, and sales argumentation. It helps teams articulate how specific solution features translate into tangible advantages for customers—either real or expected. By framing these discussions around both perception and measurable outcomes, EVE ensures that sales arguments remain credible and aligned with customer realities.

Used collaboratively, EVE strengthens dialogue between marketing and sales by linking customer insight with commercial reasoning. It helps determine which features truly drive value for different customer segments and how these features influence buying behavior and pricing sensitivity. At the same time, it provides valuable input for prioritizing capabilities in future solution development. In short, EVE is not just a model—it is a shared language for discussing value creation across the organization.

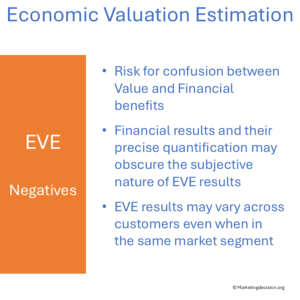

While EVE offers a disciplined framework for comparing solutions, it also carries several risks if used without careful interpretation. The most common is the confusion between perceived value and financial benefits. Value reflects customer judgment—subjective and context-dependent—whereas financial benefits result from measurable outcomes. Treating them as equivalent can lead to false assumptions about what customers are willing to pay for.

While EVE offers a disciplined framework for comparing solutions, it also carries several risks if used without careful interpretation. The most common is the confusion between perceived value and financial benefits. Value reflects customer judgment—subjective and context-dependent—whereas financial benefits result from measurable outcomes. Treating them as equivalent can lead to false assumptions about what customers are willing to pay for.

Another challenge arises from quantification itself. Although EVE translates perceived value into monetary terms for discussion, excessive reliance on numbers may obscure the model’s qualitative essence. The apparent precision of figures can create a false sense of accuracy, masking uncertainty or diversity in customer perception.

Finally, EVE results can vary significantly between customers, even within the same segment. This variability is not a flaw but an insight: it reflects different needs, usage patterns, and value priorities. Recognizing this variation helps sales teams tailor their arguments effectively and avoid generalizations that weaken the credibility of their recommendations.

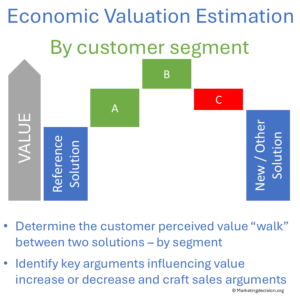

EVE can be implemented through a structured team discussion focused on a specific customer segment and two solutions—A and B.

Identify differential features: Determine which features positively or negatively impact perceived customer value.

Quantify financial impacts: Estimate the financial benefits or challenges linked to each feature, noting how they vary across customers.

Build the value waterfall: Create a diagram showing perceived value differences and associated financial impacts between the two solutions.

Consolidate insights: Summarize key findings, including perceived value, financial benefits, and the factors driving them.

Translate into action: Develop targeted sales arguments, refine sales scenarios, and align marketing and pricing strategies accordingly.

This collaborative process helps teams move from analytical reflection to commercial execution.

EVE can be applied in multiple contexts:

Preparing product launches to identify high-impact features

Prioritizing development investments based on customer-perceived value

Revisiting pricing and positioning in competitive markets

Reassessing sales tactics and narratives as customer needs evolve

EVE’s versatility makes it a valuable framework for aligning commercial and development priorities around customer value.

For a full understanding of the Economic Value Estimation (EVE) approach, it is useful to also review the Price Value Map (PVM) model. The PVM keeps price and value as two separate axes, avoiding the misconception that differences in perceived value can always be translated into price differentials. While EVE focuses on perceived value and financial benefits between two solutions, PVM provides the appropriate reference when the goal is to evaluate market positioning or customer willingness to pay.

An excellent external reference on EVE is Stephan Liozu’s Ten Golden Rules of EVE Models, published by the Professional Pricing Society. It includes many practical recommendations, among which two are particularly relevant:

“Never dollarize a product feature, but always dollarize a customer benefit.”

This principle highlights that perceived value is customer-specific, while financial benefits, though measurable, also depend on the customer’s context and use.

“Dollarize three to five value drivers, no more.”

When evaluating and comparing solutions, customers may start with many criteria but tend to crystallize their decision around a few decisive factors. The EVE model helps teams identify and focus on those critical value drivers, ensuring that sales arguments remain clear, relevant, and credible.

For complementary insights, see the Price Value Map section of this site.

The Economic Value Estimation (EVE) model is a powerful framework for comparing solutions, understanding value drivers, and refining financial arguments. It supports both marketing and sales teams in building coherent, value-based discussions while recognizing that perceived and financial value remain distinct yet interconnected.

However, EVE should not be confused with a pricing model. Its purpose is to structure discussions about customer-perceived value and financial benefits, not to determine price levels. When the objective is to assess market positioning or willingness to pay, the Price Value Map (PVM) provides the more appropriate framework — as it keeps price and value as separate axes, avoiding the misconception that value differences can always be expressed in monetary terms.

EVE is therefore best used as a collaborative interpretation tool, helping teams understand what customers truly value and how those insights can guide pricing and differentiation strategies.

Value estimation depends on understanding how customers perceive and evaluate benefits. For these underlying insights, explore our Customer Mix page.

Economic value assessments build directly on value creation principles. For a full understanding of these foundations, visit our Value Creation chapter.

EVE analysis is grounded in value-based pricing. For the broader framework supporting this method, see our Value Pricing chapter.

Economic value assessment relies on the structure and benefits defined within the Solution Mix. Explore our Solution Mix page for the foundational context.

The EVE model helps marketing and sales teams compare two solutions based on both perceived and financial value. Its main purpose is to identify and articulate the value drivers that influence customer choice and support value-based sales arguments. EVE is particularly effective when used as a collaborative framework between marketing and sales.

EVE and PVM are complementary. EVE focuses on comparing solutions and developing sales arguments based on perceived and financial value differences. PVM, on the other hand, focuses on market positioning by separating price and value as distinct axes. While EVE helps build financial reasoning, PVM helps determine pricing strategy and competitive placement.

Not directly. EVE is an interpretive model designed for analysis and discussion, not for determining exact price levels. It clarifies perceived value and quantifiable benefits but should be followed by pricing frameworks such as the Price Value Map when defining or adjusting actual prices.

The main risks are confusing perceived value with financial benefits, relying too heavily on quantification, and ignoring customer diversity within segments. To avoid these pitfalls, teams should treat EVE as a collaborative interpretation exercise that balances numerical insights with customer context.

EVE is best applied when preparing new product launches, refining sales arguments, or prioritizing development initiatives. It is also valuable when comparing current and next-generation solutions or assessing competitive offers to identify key differentiators and refine value communication.

© marketingdecision.org

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)