Solution Portfolio Management involves steering company investments across the entire portfolio of solutions. It ensures that resources—whether financial, technical, or commercial—are allocated to the most promising solution and technology developments that deliver customer and business value.

Solution Portfolio Management involves steering company investments across the entire portfolio of solutions. It ensures that resources—whether financial, technical, or commercial—are allocated to the most promising solution and technology developments that deliver customer and business value.

Solution portfolio management helps teams decide where to invest, where to protect, and where to disengage.

This approach goes beyond product development; it includes technology, sales, and service infrastructures, particularly when expanding into new markets that require specific capabilities. All investment areas—material or immaterial—should be considered, and the evaluation of return on investment should broadly include every activity essential to bringing a solution or technology to market.

In the context of Value Creation, this process answers the first key question: “Where to invest within the solution portfolio to secure growth and profitability?”

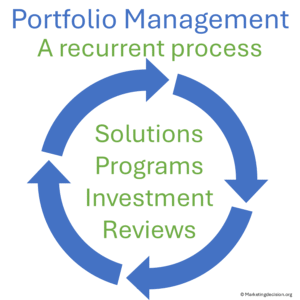

Solution Portfolio Management is an ongoing process. Teams regularly present proposals that are reviewed, discussed, and, when validated, shape the next generation of solutions. This recurring review process allows teams to reorient investment budgets as priorities evolve.

Solution Portfolio Management is an ongoing process. Teams regularly present proposals that are reviewed, discussed, and, when validated, shape the next generation of solutions. This recurring review process allows teams to reorient investment budgets as priorities evolve.

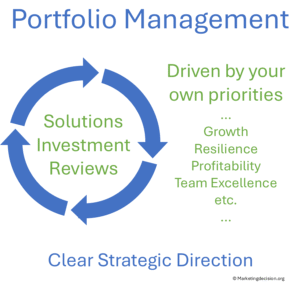

It is essential to ensure that a clear strategic direction is set, and that company priorities align with key criteria such as growth, profitability, innovation, and risk management. Teams must revisit objectives regularly and maintain clarity on acceptable risk levels and how investment programs align with overall business goals.

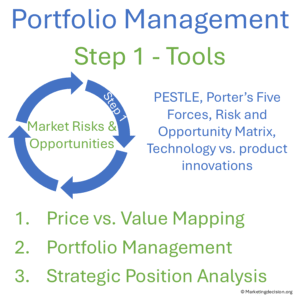

Portfolio management relies on decision tools similar to those presented in the Decision chapter. In many ways, it parallels marketing plan development, as both aim to align objectives and strategies across the organization.

While similar in purpose, solution portfolio management focuses more narrowly on solution development and operates with shorter, recurring review cycles. These cycles are often linked to product and technology reviews, where progress is assessed through intermediate evaluations between major planning periods.

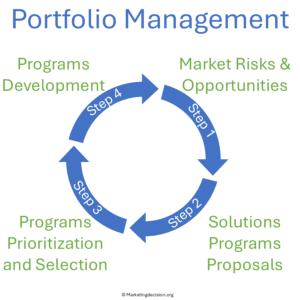

The process can be structured in four steps, much like a marketing plan. Each company can adapt these to its organization and governance structure.

The process can be structured in four steps, much like a marketing plan. Each company can adapt these to its organization and governance structure.

A review of market risks and opportunities is the first step in identifying areas for growth—whether through new solution offerings, technology, or go-to-market strategies.

A review of market risks and opportunities is the first step in identifying areas for growth—whether through new solution offerings, technology, or go-to-market strategies.

Supporting actions include market share analysis to determine which segments are expanding faster than others and where the company can consistently outperform competitors. Even modest differences in growth rates can yield significant long-term impact.

To remain competitive, it is essential to invest in solutions targeting high-growth, profitable segments, while maintaining presence in declining markets with limited investments.

Understanding competitors’ strengths and weaknesses is equally critical. A competitor’s weakness may open a unique opportunity to capture market share, while a strength may present a barrier that shapes your own development priorities. However, past performance alone cannot predict future success—customer needs and expectations must remain at the center of this analysis.

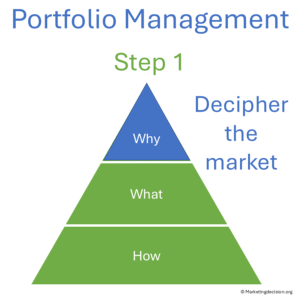

The “why” for this step is to decipher the market, identify opportunities, and create a comprehensive view of customers and competitors.

The “what” provides the foundation for comparing and prioritizing solutions, while the “how” uses proven tools to structure insights. Tools from the Decision and Market chapters—such as PESTLE, Porter’s Five Forces, Risk and Opportunity Matrix, and Scenario Planning—are particularly valuable.

Additional tools that support this step include:

By adopting a 360° market view, teams can challenge assumptions, reassess growth opportunities, and align future developments with both customer expectations and company objectives.

Teams responsible for market segments and solutions generate program proposals with supporting rationale and a clear description of internal and external risks.

Opportunities should be assessed in light of market dynamics and competitive movements. Early identification of trends enables companies to adapt faster.

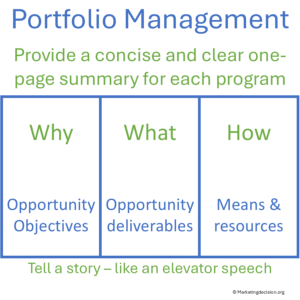

To ensure clarity, teams should use a standard proposal format structured around the familiar “Why–What–How” framework:

Using a consistent template allows all projects to be evaluated on an equal basis, supporting transparent decision-making.

Prioritizing programs requires a balance between long-term initiatives and short-term opportunities. Decision-making tools from the Decision chapter—such as ease-of-implementation versus impact matrices—can facilitate structured discussion.

Programs can also be plotted on new-market vs. technology axes to evaluate their potential contribution.

Teams should explore “what if” scenarios to test different pathways under varying market or technology conditions.

Ongoing attention to emerging technologies, competitive entries, and customer experience is vital to ensure that selected programs deliver sustainable differentiation.

This final step ensures that investment funds are effectively used. Program execution should be monitored regularly against objectives, with lessons learned shared to reinforce best practices and avoid recurring issues.

Budget discipline is critical: both overestimated and underestimated budgets can create inefficiencies. Regular reviews help ensure funds are directed toward the highest-impact initiatives.

Solution Portfolio Management is a core activity in value creation, where companies assess and coordinate their solution development priorities and make both short- and long-term investment decisions.

By establishing consistent, transparent mechanisms, cross-functional teams stay aligned and make coordinated investment choices.

To complement this approach, explore the related tools in this chapter:

Portfolio prioritization becomes sharper when aligned with customer segments. For segmentation foundations, visit Customer Segmentation Principles.

Portfolio decisions rely on clear customer expectations and segment behaviors. Explore our Customer Mix framework for these foundational insights.

Portfolio decisions rely heavily on how solutions create value across segments. Explore our Value Creation chapter for the underlying concepts.

Portfolio discussions are always anchored in the broader Solution Mix, which defines how solutions are structured and differentiated across segments.

Solution portfolio management focuses on market-facing solutions and technologies, while project portfolio management oversees individual projects or internal initiatives. The former guides strategic investment in what solutions to build or enhance.

Reviews should occur on a regular, recurring basis—often quarterly or bi-annually—to adjust investments and priorities based on evolving market conditions.

Typically, marketing, solution management, finance, engineering, and sales all contribute to ensure alignment between market needs, technical feasibility, and business performance.

Solution Portfolio Management identifies where to invest. Portfolio Graph and Strategic Position Analysis help compare and visualize those choices, while Price-Value Mapping helps position them competitively.

© marketingdecision.org

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

© 2026 MARKETING DECISION SOLUTIONS. All Rights Reserved.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Stripe is a payment processing platform that enables businesses to accept online payments securely and efficiently.

Service URL: stripe.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)