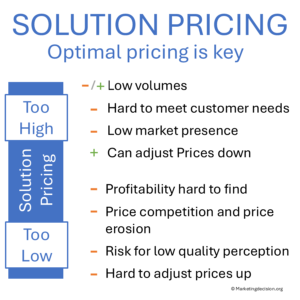

Setting the right price for a solution is key. If the price is too high, the solution may fail to meet customers’ needs and expectations, leading to poor market positioning and potential failure. On the other hand, if the price is too low, the company may create pressure on competitors, forcing them to lower their prices as well. This can result in a challenging, less profitable market environment where all players struggle to meet profitability targets.

Customer perceived value and price are critical factors in purchase decisions. While these two concepts are closely connected, they are also quite different. Customers might perceive one solution as having greater value than another but still choose the lower-priced option. Alternatively, they might select the higher-priced solution for its perceived higher value.

Customer perceived value and price are critical factors in purchase decisions. While these two concepts are closely connected, they are also quite different. Customers might perceive one solution as having greater value than another but still choose the lower-priced option. Alternatively, they might select the higher-priced solution for its perceived higher value.

Perceived value is subjective and varies from customer to customer, in contrast price is determined by the company and can be fixed or adjusted through commercial decisions. This is why the price-value mapping tool is so valuable, as it allows for a comparison of relative strengths in terms of perceived value and price.

This chapter focuses on pricing and how companies can manage it to meet their objectives while ensuring customer satisfaction and encouraging repeat purchases when customers decide to renew or buy a new solution.

A common definition of price is the amount of money a customer is willing to pay for goods or services. This definition is simple but not entirely accurate because price is set by companies. Some customers might be willing to pay more if they perceive the solution to have greater value and be worth a higher price. This is why sales teams often determine the optimal discount to match the price the customer is willing to pay while ensuring the company is satisfied with the offered price.

Price is often accompanied by suffixes such as “list,” “target,” “minimum,” and “discounted,” which, when combined with the word price, provide more specific meanings.

Price is often accompanied by suffixes such as “list,” “target,” “minimum,” and “discounted,” which, when combined with the word price, provide more specific meanings.

The list price or standard price is the official maximum price for a solution, whether it be a service or goods. A service can be divided into different components, each with its own list price. These prices are additive and linear, meaning the total price for purchasing multiple items is simply the sum of the list prices.

Meanwhile, a packaged price is an approach used to reduce the sum of list prices when multiple items are purchased together. This is common in industries like automotive, where optional features are grouped to reduce the total list price and enhance competitiveness.

The discounted price is the price offered to a customer, often determined by a salesperson. It reduces the overall cost for the customer, personalizes the purchase, and often sets a time limit on the offer. Companies that rely on salespeople can customize sales conditions based on the customer’s market segment, optimizing the final offer to win the order with the right content and price positioning.

The sale price is the price applied during sales periods, often used to reduce inventory and prepare for new product launches when final sale price is the price agreed upon at the completion of a transaction, after all negotiations, discounts, taxes, and fees have been applied.

A target price is the price a company aims for, and salespeople are incentivized to achieve it. If the salesperson exceeds this price, they may receive higher compensation, sometimes with an additional bonus for hitting certain sales volumes or targets. If the price falls below the target, the salesperson might need higher approval or may receive reduced compensation. Salespeople are often adept at negotiating internal compensation based on exceptions to the standard sales plan.

There is naturally a degree of price elasticity, where some customers will pay more for a solution and others will pay less, possibly due to loyalty to another supplier. This raises the question: how can a company win over both groups of customers to increase volume while maintaining optimal profitability? This is why salespeople are given limited discount authority. Besides demonstrating the value of a solution, skilled salespeople know when a higher price can be proposed and when the price needs to be lowered to avoid losing to competitors.

There is naturally a degree of price elasticity, where some customers will pay more for a solution and others will pay less, possibly due to loyalty to another supplier. This raises the question: how can a company win over both groups of customers to increase volume while maintaining optimal profitability? This is why salespeople are given limited discount authority. Besides demonstrating the value of a solution, skilled salespeople know when a higher price can be proposed and when the price needs to be lowered to avoid losing to competitors.

The order price refers to the price at the time of order entry, when the customer commits to purchasing from the company and resources are allocated to deliver the proposed solution. At this point, some companies remove items from their inventory, while others begin manufacturing the ordered solution.

The sale final price is the final price when the transaction is completed. Depending on the market and country regulations, the conditions for recognizing a sale may vary. It is essential to track both the order price and the final sale price to ensure that pricing is properly managed from the salesperson’s input to the actual transaction completion.

Mistakes during order entry, delivery issues, or customer dissatisfaction can lead to concessions that must be understood, managed, and corrected.

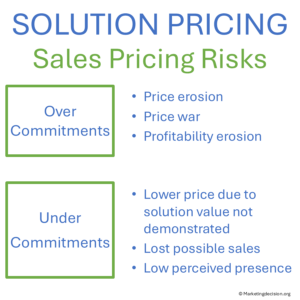

Such defects need to be analyzed to prevent repetition. Salespeople should be provided with proper documentation and tools to avoid over-commitments or under-commitments. Over-commitments, where unrealistic capabilities or timelines are promised, can lead to costly concessions and reputational damage, while under-commitments may result in solutions not being proposed to their full potential, either losing the deal to competitors or winning with a lower price than expected, thus reducing profitability and entering into price competition.

Price management varies considerably across markets, ranging from flow products with fixed prices to prices adjusted for each customer based on their specific needs.

For flow products, such as those in retail stores, fixed prices allow for consistent conditions shared across all customers, with discount schemes applied for loyal customers. This enables precise price control. Sales decisions can also be used to manage stock levels when new solutions are introduced to the market, and previous ones need to make room for the new arrivals. Overall, prices, as well as inventory, must be closely monitored to ensure that sales objectives are met.

For flow products, such as those in retail stores, fixed prices allow for consistent conditions shared across all customers, with discount schemes applied for loyal customers. This enables precise price control. Sales decisions can also be used to manage stock levels when new solutions are introduced to the market, and previous ones need to make room for the new arrivals. Overall, prices, as well as inventory, must be closely monitored to ensure that sales objectives are met.

When prices need to be flexible to adapt to markets, customers, and configurations, pricing schemes are developed to take advantage of customer segments and specific needs. For instance, customers who book early benefit from lower prices compared to those who purchase last minute, who may pay significantly higher prices. Customers captured from competitors without triggering a price war may also receive higher discounts.

Managing prices is crucial. Customer pricing approaches must be continually optimized across multiple departments, including marketing, sales, finance, and purchasing. Sales teams hold weekly meetings to maintain visibility on future opportunities and foster cross-team expertise. Leveraging competitors’ weaknesses can help secure more deals by adjusting prices and configurations in line with the company’s market positioning. Insights gained from these efforts can be shared with marketing teams to refine sales pitches and provide better support in complex or challenging deal situations. Both communication and frequency are critical. By building trust among multiple partners, subtle market changes can be identified early.

Managing prices is crucial. Customer pricing approaches must be continually optimized across multiple departments, including marketing, sales, finance, and purchasing. Sales teams hold weekly meetings to maintain visibility on future opportunities and foster cross-team expertise. Leveraging competitors’ weaknesses can help secure more deals by adjusting prices and configurations in line with the company’s market positioning. Insights gained from these efforts can be shared with marketing teams to refine sales pitches and provide better support in complex or challenging deal situations. Both communication and frequency are critical. By building trust among multiple partners, subtle market changes can be identified early.

Organizing price management around two approaches—Price Setting and Price Getting—clarifies the roles and responsibilities of those who determine pricing strategies and field rules, and those who execute and implement these strategies.

Price Setting involves solution marketing teams, who focus on optimizing the “Go-to-Market” strategy to distribute goods and services successfully. These teams are measured by their ability to meet company objectives, typically outlined in a marketing plan. They deliver on goals such as market share, penetration, volume, and overall performance versus plan. Usually part of the marketing organization, they introduce solutions to the sales team with all necessary documentation and a clear pricing strategy.

Price Setting involves solution marketing teams, who focus on optimizing the “Go-to-Market” strategy to distribute goods and services successfully. These teams are measured by their ability to meet company objectives, typically outlined in a marketing plan. They deliver on goals such as market share, penetration, volume, and overall performance versus plan. Usually part of the marketing organization, they introduce solutions to the sales team with all necessary documentation and a clear pricing strategy.

Price Getting, on the other hand, is managed by sales and support teams. These teams are responsible for quoting, proposing, and delivering solutions to customers. Their role involves promoting solutions, winning customers, and staying ahead of market trends and competition. Unlike Price Setting, which happens long before a product launch, Price Getting requires day-to-day adjustments and individualized transactions.

By recognizing these two key mechanisms and ensuring teams understand their roles and responsibilities—with clear operating procedures – e.g. described with a RACI model—teams can deliver on both price setting and price getting with transparency and accountability. Best practices are captured and incorporated into the team’s knowledge base. Responses to competitive moves become more efficient, delivering better results. Team creativity and excellence become the standard way of working.

Price setting, as introduced, is a process led by marketing to define and implement pricing strategies for existing or new solutions. This process goes beyond setting a simple list price. It requires evaluating the broader ecosystem and determining the methodology for pricing.

Price setting, as introduced, is a process led by marketing to define and implement pricing strategies for existing or new solutions. This process goes beyond setting a simple list price. It requires evaluating the broader ecosystem and determining the methodology for pricing.

Since price is closely related to the perceived value to customers, it is crucial to assess how value is perceived by different customers and how sales tools can empower salespeople to demonstrate this value accordingly. Additionally, the entire approach for discounts, sales strategies, and escalation procedures, if needed, must be defined during price setting. Without demonstrating value, no price can be set or sustained. Therefore, value and price go hand in hand.

One of the most effective tools for evaluating perceived value is the Voice of the Customer, which involves carefully monitoring past and current transactions. Leveraging insights from existing solutions to prepare for the introduction of new ones is important to compare various solutions from both your company and competitors.

Various tools can be used to evaluate solution performance, and sales teams can provide valuable information to their marketing colleagues, including competitor data on features, messaging, and overall sales strategies. Such information is useful but must be handled with care to avoid misinterpretation. Salespeople serve as excellent sentinels in the market, and subtle changes are quickly identified by those trained to report and debrief on new situations. This creates a win-win dynamic between sales and marketing, where newly identified threats are assessed and turned into winning strategies.

In the case of negotiated prices, salespeople may sometimes be perceived as biased. When a deal is lost, some will claim the price was too high, while when a deal is won, they may credit their own efforts and skills. This is worth investigating further—price and value are linked, and salespeople should be interviewed about their sales tactics and messaging. It’s possible the price was indeed too high in the case of the lost deal, or too low in the case of the won deal. Alternatively, the value may not have been perceived, or the competition may have offered a better solution for the customer’s needs—or perhaps the opposite was true. A common rule is to always take the opportunity to discuss deals with customers—both won and lost—and explore the reasons behind their decisions. What factors influenced the final decision? How was value assessed? What was the competition’s final move, and how did it affect the decision?

Learning from the Customer Decision Process

When questioning customers about their final decision-making process, they will likely mention only two or three decisive criteria. The sales process begins with customers trying to understand the solutions offered to them, sometimes developing complex spreadsheets to compare solutions. Throughout this process, they also form criteria for comparison. However, as the sales process progresses, it simplifies, and in the end, only a few essential criteria determine the final decision. It’s crucial to identify these key arguments that influenced the choice between your solution and the competitor’s.

Understanding these factors is important for several reasons:

Learning which values were perceived as key differentiators. These can often be integrated into future sales pitches, becoming communication anchors that may also be used by your competition. This is where you may need to adjust your messaging and enhance your sales pitches to your advantage.

Understanding how price factored into the decision. Was price a key differentiator? If so, this may indicate that pricing is not competitive when it becomes the sole reason for a decision. If you win on price alone, your competition is likely to respond by lowering their prices. Be cautious of situations where pricing triggers a downward spiral.

Multiple approaches can be considered for gathering customer feedback. Continuous methods involve discussions with customers who have just made a purchase, using free-form or structured interview guides.

These aim to understand customers, their potential segments, what motivated their decisions, the key benefits they obtained from the solutions they chose, and their appreciation of your company’s efforts.

Interviews with existing customers can provide valuable insights for future product introductions. These discussions can reveal key sales arguments and, in some cases, turn these customers into strong advocates for complex sales.

By sorting the results by customer segments and subsegments, you can develop tailored scenarios for each customer group.

Interviews with competitors’ customers are often more challenging to obtain but are extremely valuable. They can help identify how to demonstrate your solutions and what might convince them to choose your offerings over your competitors’. Converting loyal customers is difficult, and caution must be exercised during these interviews to avoid revealing features that could benefit your competition.

Organizing focus groups is another approach, grouping customers with similar profiles to test possible scenarios. When running focus groups, it’s important to help customers understand the objectives of the discussion. Focus groups provide opportunities to test the impact of sales arguments, discuss alternative scenarios, and involve customers who may or may not favor your company’s solutions. These groups are often conducted by market research companies to ensure confidentiality and prevent biased responses.

Organizing focus groups is another approach, grouping customers with similar profiles to test possible scenarios. When running focus groups, it’s important to help customers understand the objectives of the discussion. Focus groups provide opportunities to test the impact of sales arguments, discuss alternative scenarios, and involve customers who may or may not favor your company’s solutions. These groups are often conducted by market research companies to ensure confidentiality and prevent biased responses.

There are many other ways to learn from customers, some of which are simple and cost-effective, such as learning from sales operations themselves. Marketing professionals can spend time shadowing salespeople, learning firsthand about the sales process. It’s also useful to collaborate with the pricing team, if one exists, or to participate in specific customer meetings alongside the sales team. These experiences provide valuable opportunities to learn from customers and refine marketing strategies to be more effective in the field.

While the Voice of the Customer is essential and remains the best approach to evaluate the overall strategy, other tools that quantify pricing strategies are also key.

While the Voice of the Customer is essential and remains the best approach to evaluate the overall strategy, other tools that quantify pricing strategies are also key.

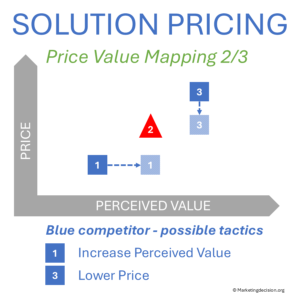

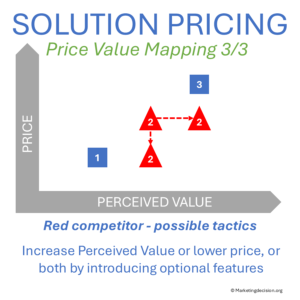

The Price-Value Map is key for comparing perceived value and proposed price—sometimes referred to as the perceived price due to the complexity of certain pricing scenarios. As mentioned, price and value are distinct entities: the value perceived by customers and the price set by companies.

By mapping solutions along these axes, various scenarios can be developed. For marketing teams, this framework helps with strategic positioning, determining and recommending solutions for each customer segment.

By mapping solutions along these axes, various scenarios can be developed. For marketing teams, this framework helps with strategic positioning, determining and recommending solutions for each customer segment.  These recommendations can then be designed into sales scenarios for similar situations. However, relying on the same scenario repeatedly can become predictable to your competition. It’s wise to allow sales teams to adjust strategies case by case, based on market conditions, customer experience, and needs. The Price-Value Map becomes a useful tool for sales teams to evaluate different scenarios and make the right moves at the right time.

These recommendations can then be designed into sales scenarios for similar situations. However, relying on the same scenario repeatedly can become predictable to your competition. It’s wise to allow sales teams to adjust strategies case by case, based on market conditions, customer experience, and needs. The Price-Value Map becomes a useful tool for sales teams to evaluate different scenarios and make the right moves at the right time.

The Price-Value Map helps sales teams position solutions and prices correctly, enabling last-minute adjustments in configuration and price that in an instant make your solution much more attractive.

The Economic Value Estimation (EVE) model, discussed in various sections of this site, is valuable because it helps identify how additional value can be derived from added capabilities. It’s a great tool for comparing past and future solutions, both your own and those of competitors.  It seems simpler to use than the Price-Value Map model but its main disadvantage is that it tends to blur the distinction between the value and price axes.

It seems simpler to use than the Price-Value Map model but its main disadvantage is that it tends to blur the distinction between the value and price axes.

Value is not additive in the same way price is, and added value is customer-dependent, as we’ve seen. Pricing based on an EVE model can cause issues unless used in combination with other tools, such as the Voice of the Customer. In practice, EVE can provide key arguments and insights into the financial benefits expected by customers, offering two main advantages: understanding which sales arguments to use with customers, and determining the additional price that can be charged for new capabilities. However, the additional price may range from zero or even negative if the new feature impacts other capabilities important to the customer. Conversely, it may be very high if the feature is unique and highly anticipated by customers, creating an offering no competitor has yet introduced.

Conjoint studies aim to assess the differential price customers are willing to pay for solutions with varying features. This quantitative approach has been demonstrated in the airline industry, where seat size and comfort are evaluated in relation to customers’ willingness to pay for different destinations. These studies are expensive to conduct due to the large volumes of data required. However, they are valuable when significant investments are being considered before launching a new offering.

Building a price model is crucial for determining which prices should be applied, when, and how for each market segment and solution.

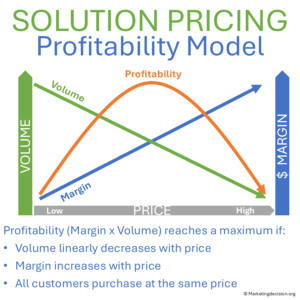

In this model, price is represented on the horizontal axis, while volume and total margin are on the vertical axes. As price increases, volume decreases, while margin increases with the rise in price. Total margin, calculated as volume multiplied by margin, forms an inverse parabolic curve. This indicates that there is an optimal price that maximizes total profitability by finding the best balance between volume and margin.

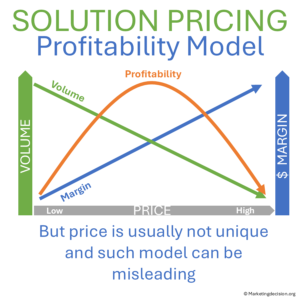

However, this model can be misleading if misused. In many market environments, perceived value varies by individual customers, not just by customer segments. As a result, the correct price model should account for the statistical sum of all customer situations where sales successfully conveyed value and proposed an appropriate price. At a minimum, market segments should be considered to establish prices and analyze deal margins distribution.

However, this model can be misleading if misused. In many market environments, perceived value varies by individual customers, not just by customer segments. As a result, the correct price model should account for the statistical sum of all customer situations where sales successfully conveyed value and proposed an appropriate price. At a minimum, market segments should be considered to establish prices and analyze deal margins distribution.

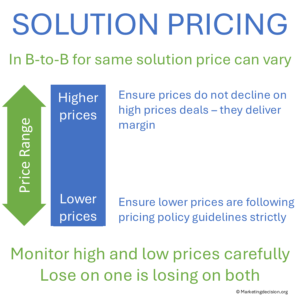

It is important to remember that high-price deals allow the company to make some deals at lower prices and, therefore, lower margins. If high-price deals are lost, the lower-price deals may also start to slip. It is essential to give high-price deals at least as much attention as lower-price ones, as losing them can undermine profitability and the company’s long-term reputation.

Price getting, as previously explained, is the responsibility of the sales team. This is where individual salespeople or teams develop their sales approach for each deal and finalize their offer and pricing strategies.

Ultimately, each deal is either won, lost, or abandoned—by the company or the customer. To improve future deals, it is crucial to leverage CRM (Customer Relationship Management) systems to capture learnings from all outcomes.

Price setting and price getting are two sides of the same coin. While marketing prepares the strategy, solutions, and pricing approach, the sales team develops the local strategy to win with each customer. As a result, learning from sales operations is valuable in assessing the effectiveness of the strategy and the execution of the sales team. When communication is clear, both functions succeed. Price getting, in particular, serves as a feedback loop for marketing to adjust its strategy, while price setting guides the sales team’s operations.

This loop between price setting and price getting requires careful attention. Price-related issues must be managed effectively and addressed swiftly when possible. Proper metrics and visibility are essential for making informed decisions. Multiple metrics can be designed, and the best ones are those tied to key marketing and sales performance indicators. Typical metrics include:

Price index and price erosion: These evaluate customer price performance and should be measured both statistically and individually. Statistical measurements help identify trends amid noisy data, factoring in market segments, and seasonality. Individual deal exceptions, such as major sales concessions linked to specific marketing campaigns, should be isolated to avoid skewing the analysis.

Price index and price erosion: These evaluate customer price performance and should be measured both statistically and individually. Statistical measurements help identify trends amid noisy data, factoring in market segments, and seasonality. Individual deal exceptions, such as major sales concessions linked to specific marketing campaigns, should be isolated to avoid skewing the analysis.

Deals with discounts or margin impact must be carefully analyzed. Sales errors need to be identified, and issues related to discount rules should be addressed. Some customers and markets are particularly sensitive to discounting, often due to cultural factors. For example, in some countries, high discounts may be welcomed, while in others, such discounts may undermine the perceived value of the solution.

Understanding sales practices is crucial for optimizing price getting. Scenarios where sales apply a single pricing scheme across all customers should raise concerns. Patterns of consistent deal losses must also be investigated, as these could relate from internal or external factors. In public tenders, a competitor’s change in strategy may only be identified after several months when bids are opened, and decisions become public. A competitor’s move might go unnoticed for a while, leading to multiple offers at the wrong price point.

Effective sales operations are key to ensuring frequent communication among sales teams and with other departments to coordinate and refine the go-to-market approach.  Sales teams often organize early-week calls to review deals, set priorities, and address specific needs for marketing or sales support.

Sales teams often organize early-week calls to review deals, set priorities, and address specific needs for marketing or sales support.

One effective approach with marketing is to establish “business rooms” where deals are discussed among marketing, sales, and pricing teams. These meetings, often called “war rooms” or “win rooms” or other fancy names, aim to facilitate quick decisions and rapid support for sales teams facing market challenges or extraordinary high-stakes deals. Such rooms are designed for short-term use and should be implemented to provide immediate intervention when a sales team faces multiple issues simultaneously. The objective is to resolve several problems in a short amount of time, not just one issue at a time.

Companies are increasingly developing pricing teams to provide guidance and support to marketing and sales teams in both price setting and price getting. A pricing team aims to assist in three key areas:

Companies are increasingly developing pricing teams to provide guidance and support to marketing and sales teams in both price setting and price getting. A pricing team aims to assist in three key areas:

Visibility and Reporting on Pricing

Measuring price execution—from setting the price list to enforcing discount rules and evaluating performance—is key. This analysis helps identify transactions that fail to meet targets.

Issues encountered with customers or sales can be reviewed and applied to future deals. Undesirable sales practices, once identified, can be quickly corrected.

Price can be visualized as a waterfall, starting from the list price to the order price, and then from the order to the final sales price, accounting for potential price erosion due to sales or technical concessions. Since sales teams are often compensated based on their performance when an order is booked, evaluating any performance drop between order and sales is key to avoiding systemic sales concessions. Sales teams, however, should not be penalized for issues in delivery that are beyond their control.

Support for Price Setting

Determining price through methods like Economic Value Estimation (EVE), Price-Value Mapping, and Voice of Customer techniques requires discipline. A pricing team can provide training and engage with marketing teams to showcase efforts in setting prices effectively.

Determining price through methods like Economic Value Estimation (EVE), Price-Value Mapping, and Voice of Customer techniques requires discipline. A pricing team can provide training and engage with marketing teams to showcase efforts in setting prices effectively.

The role of the pricing team is not to replace marketing, but to ensure that marketing delivers its pricing recommendations with excellence. Due to their involvement in price getting, the pricing team can quickly inform marketing of significant pricing issues that require immediate attention.

Recommendations for adjusting list prices and optimizing pricing strategies can be proposed to marketing, helping avoid price escalation from becoming a systemic issue between the sales and pricing teams.

Support for Price Getting

Salespeople collaborate with their organization to sell the value of their solutions, applying go-to-market strategies. When challenges arise—such as complex deals requiring extra attention—the pricing team can analyze the transaction and provide recommendations, working closely with marketing and sales. Escalating a deal to the pricing team has both benefits and drawbacks. The advantage is that the pricing team offers dedicated support, quickly analyzing situations and proposing solutions aligned with marketing strategy. The downside occurs when salespeople escalate deals too frequently, disengaging marketing from its role in setting appropriate list prices and discount rules, especially after periods of price erosion.

Salespeople collaborate with their organization to sell the value of their solutions, applying go-to-market strategies. When challenges arise—such as complex deals requiring extra attention—the pricing team can analyze the transaction and provide recommendations, working closely with marketing and sales. Escalating a deal to the pricing team has both benefits and drawbacks. The advantage is that the pricing team offers dedicated support, quickly analyzing situations and proposing solutions aligned with marketing strategy. The downside occurs when salespeople escalate deals too frequently, disengaging marketing from its role in setting appropriate list prices and discount rules, especially after periods of price erosion.

For most companies, a pricing team serves as a critical tool to support marketing and sales in all actions related to price setting and price getting. Their role is to represent various functions and assist without replacing them. Where they play a unique role is in delivering tools and techniques to ensure best practices are followed. Pricing teams also implement specific operating mechanisms to provide transparency and visibility into pricing, helping the company understand success and failure in pricing operations.

For this reason, it can be difficult to assign a pricing team to any one department. It could be part of the marketing, sales, or finance functions. The most logical alignment is with marketing since pricing strategy ultimately falls under marketing’s responsibility.

Assigning pricing to the finance department is probably the least effective option. Since prices vary from customer to customer, the best transactions allow the company to win the appropriate share across all market segments, even when some involve lower margins. Finance teams tend to stop lower-margin deals, while the optimal approach often involves balancing a mix of less and more profitable deals to achieve the targeted volume.

Assigning pricing to the finance department is probably the least effective option. Since prices vary from customer to customer, the best transactions allow the company to win the appropriate share across all market segments, even when some involve lower margins. Finance teams tend to stop lower-margin deals, while the optimal approach often involves balancing a mix of less and more profitable deals to achieve the targeted volume.

Assigning pricing to the sales function could lead to pricing slippage in two ways: First, high-level sales decisions might authorize unprofitable deals, potentially triggering a price war. Second, pricing decisions could be driven by metrics tied to sales performance and compensation rather than customer-perceived value of the solutions.

Profitability and Pricing Teams

Another benefit of having a pricing team is the ability to calculate deal profitability, which is critical for companies to meet their goals. However, pricing decisions must always be contextualized based on the customer’s perceived value of both the company’s and competitors’ solutions. For instance, if a deal is won with a lower price in a situation where the customer perceives less value than usual but it delivers a suitable margin, think carefully. In future deals, competitors may anticipate similar strategies and respond with a price reduction that could become permanent.

Overall, providing profitability information to sales teams is a double-edged sword. On one hand, it prevents significant losses from poor deals. On the other hand, it might encourage salespeople to offer lower prices in situations where they could have won with higher margins. This can ultimately harm the mix of solutions that allow the company to meet both volume and margin targets across segments. Lower pricing strategies may be acceptable in rare cases, such as when an older solution is being phased out in favor of a new range with higher perceived value and pricing.

There are many useful and quite enlightening Pricing papers written by Stephan Liozu:

https://www.stephanliozu.com/papers

Read in particular the article “When Data Doesn’t Give You the Expected Answers” that addresses various situations where wrong conclusions are derived from incomplete or improperly handled data. What can you do to remove the poison?”

Price setting and price getting are two key elements of the pricing loop, where strategy is both determined and applied. Addressing issues quickly and learning from them is essential. Losing numerous deals over an extended period can harm market presence, allowing competitors to adjust and take the lead.

In many markets, the number one competitor—by share, presence, and volume—becomes the primary target for others. Holding the top position isn’t always easy, but it provides a unique market leader status that customers recognize and understand. This role is essential for building long-term leadership and market presence.

In many markets, the number one competitor—by share, presence, and volume—becomes the primary target for others. Holding the top position isn’t always easy, but it provides a unique market leader status that customers recognize and understand. This role is essential for building long-term leadership and market presence.

As this chapter focuses on value, it’s important to note that the best marketers aren’t necessarily those who sell the most advanced or high-priced solutions. Rather, they are those who understand that they may not have the best product, but know how to craft a pricing strategy and overall approach to outperform their competition.

© marketingdecision.org

Solution pricing often represents the visible “tip of the iceberg”—a stage that follows extensive groundwork, including market analysis, customer segmentation, and the design of high-potential solutions. Pricing is where product positioning is crystallized, drawing on insights from market research, segmentation, and an understanding of customer preferences.

The Price Value Map is an essential tool for analyzing both positioning and pricing. It visually compares your product’s price and performance against competitors, helping you determine if your pricing is justified by the value delivered and ensuring you remain customer-focused in your pricing decisions. This approach supports value-based pricing strategies, enabling you to identify pricing opportunities and competitive advantages.

The Economic Value Estimation (EVE) model is another powerful tool. EVE quantifies the differential value perceived by customers between two solutions, typically your offering and the next best alternative. By calculating the monetary benefits and costs from the customer’s perspective, EVE helps develop compelling sales arguments tailored to different customer segments and supports value-based selling.

Together, these tools ensure that pricing decisions are grounded in both market realities and customer perceptions, maximizing both competitiveness and profitability.

The following section may include tools, some free, some with a fee to support this site development. If you consider a tool should be presented in this section and is missing, please let us know at: contact@marketingdecision.org

EVE – Economic Value Estimate is an effective tool for evaluating and comparing two solutions, helping to develop sales arguments based on selected financial terms and customer benefits that differentiate these solutions. Specifically, it provides the capability to compare the value delivered to customers from the same market segments and to consider the associated financial benefits. For sales and marketing, this approach is valuable for assessing the most effective financial sales arguments in various sales situations.

EVE is complementary to and distinct from Price Value Mapping (PVM). While both methods consider value, they have different objectives. PVM maps price as a comparison of value, whereas EVE helps decode sales arguments—particularly financial ones—to recommend a solution to a customer. It contrasts price with financial benefits. Both methods have their advantages and are worth utilizing in marketing and sales.

© 2025 MARKETING DECISION SOLUTIONS. All Rights Reserved.